Webhook

Webhooks are used to notify clients when one of their recipients has completed the W-8BEN. The webhook payload includes W-8BEN data such as the recipient’s name, address, TIN(US/Foreign), as well as the link to download the completed form.

For detailed information, Click here.

How to configure webhooks for W-8BEN status

-

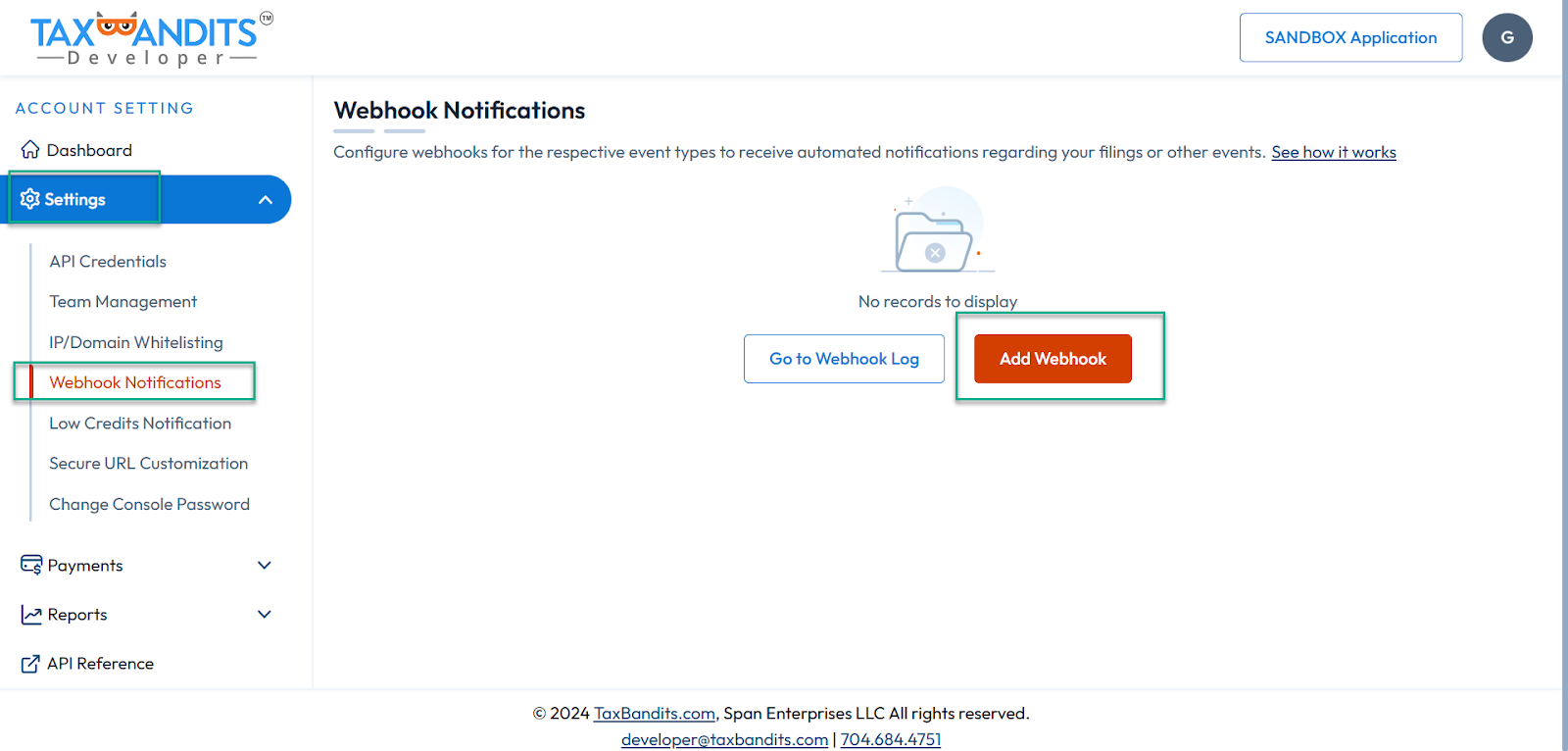

Log in to the developer console.

- Sandbox: sandbox.taxbandits.com

- Live: console.taxbandits.com

-

Navigate to Settings >> Webhooks.

-

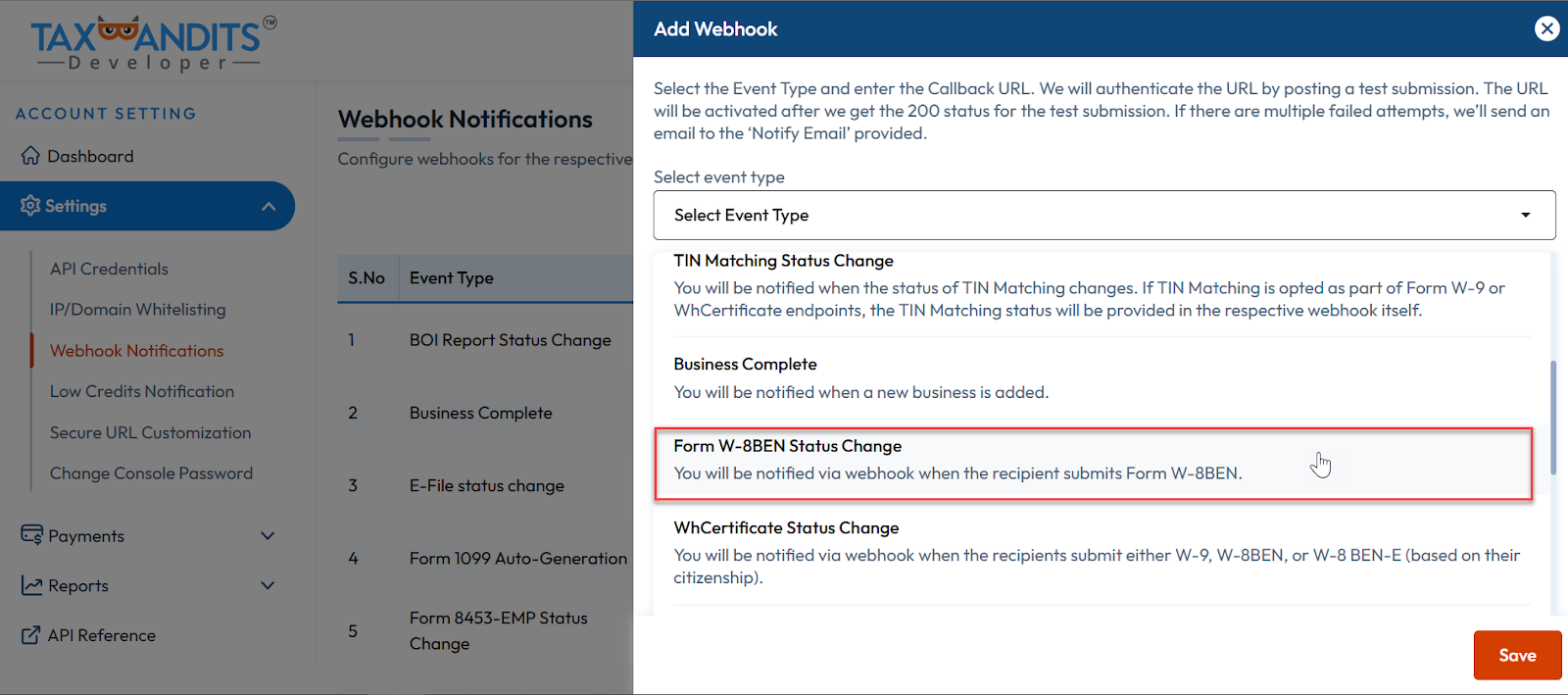

Click ‘Add Webhook’. Choose the event type as ‘Form W-8BEN Status Change’.

-

Enter your Callback URL where you want to receive notifications and click Save. You can add up to 5 Webhook URLs and choose the Callback URL to which the webhook response needs to be posted.

Note:-

Upon saving a webhook in TaxBandits, a unique Webhook Reference (GUID) is generated for each Callback URL you register.

-

Store these Webhook References on your end. When making API requests (e.g., to the FormW8BEN/RequestByUrl endpoint), you can specify the preferred Callback URL by including the corresponding WebhookRef in the request JSON.

-

The WebhookRef node is optional. If you provide a WebhookRef, the webhook notifications for that request will be sent to the Callback URL tied to the specified Webhook Reference.

-

If you do not specify a WebhookRef, webhook notifications will be sent to your default Callback URL (usually Callback URL 1).

-

Ensure your callback URL is valid and publicly accessible. Upon saving, the API sends a sample JSON payload to your callback URL.

-

Your server must respond with HTTP status code 200 to keep the webhook active.

-

If your callback URL does not return HTTP 200, the webhook will become inactive. You can retry posting sample data to reactivate it.

-

By default, the webhook response will include the recipient’s TIN. If you prefer not to include the TIN, you can adjust this preference in the console. See how

Response Body

| Field | Type | Description |

|---|---|---|

| SubmissionId | Guid | Unique identifier of a submission |

| WebhookRef | Guid |

|

| Requester | object | Requester information. |

| BusinessId | Guid | Unique identifier of a business |

| BusinessNm | String | Requester Name. If the requester is a Business, then the Business Name will be returned. If the requester is an Individual, then the Payer’s full name will be returned. |

| FirstNm | string | First Name of the Individual |

| MiddleNm | string | Middle Name of the Individual |

| LastNm | string | Last Name of the individual |

| Suffix | string | Suffix of the Individual |

| TINType | string | TIN Type of the Requester. |

| TIN | string | Taxpayer Identification Number of the requester. |

| DBAId | String | Unique Identifier for the DBA. |

| DBARef | String | Unique identifier for each DBA. This identifier can be used in future references of the DBA in the API. |

| PayeeRef | String | Unique identifier of the recipient |

| W8BENStatus | String | Status of the W-8BEN. |

| StatusTs | String | Timestamp of the W-8BEN Status. |

| FormW8BENRequestType | String | Form W-8BEN requested Type.

|

| PdfUrl | String | URL to download the completed W-8BEN. Note: This URL will expire in 24 hours. |

| String | Email Address of the recipient. This is the email to which the W-8BEN request was sent.The value will be null if the Form W-8BEN was requested using the API method RequestByURL | |

| FormData | Object | Form W-8BEN data of the recipient. |

| NmOfIndividual | string | Name of the Foreign Individual. |

| CitizenOfCountry | string | Recipient country of citizenship. |

| USTINType | string | TIN type of the recipient. Either SSN or ITIN. |

| USTIN | string | Recipient’s TIN |

| ForeignTIN | string | Foreign TIN of the recipient. |

| IsFTINNotLegallyRequired | Boolean | When TRUE, Identifies that benificial owner on line 1 is not legally required to obtain an FTIN from their jurisdiction of residence. |

| ReferenceNum | string | Recipient’s reference number. You can use this field to enter any identification number you have for the recipient. |

| DOB | string | Date of Birth of the recipient |

| PermanentAddress | Object | Recipient’s permanent address. |

| Address1 | string | Recipient US Address 1 (street address or post office box of that locality). This will be pre-filled on the Form. |

| Address2 | string | Recipient US Address 2 (suite or apartment number). This will be pre-filled on the Form. |

| City | string | Recipient’s City |

| State | string | Recipient’s State |

| Country | string | Recipient’s Country |

| PostalCd | string | Recipient’s Zip Code |

| MailingAddress | Object | Recipient’s mailing address. |

| Address1 | string | Recipient’s Address 1 (street address or post office box of that locality). This will be pre-filled on the Form. |

| Address2 | string | Recipient’s Address 2 (suite or apartment number). This will be pre-filled on the Form. |

| City | string | Recipient’s City |

| State | string | Recipient’s State |

| Country | string | Recipient’s Country |

| PostalCd | string | Recipient’s Zip Code |

| TaxTreatyBenefits | Object | Tax Treaty Benefits. |

| BeneficiaryCountry | string | Country where the recipient claim to be a resident for income tax treaty purposes. |

| ClaimingProvArticlePara | string | Article and paragraph of the treaty benefits. |

| RateOfWH | string | Rate of Withholding. |

| TypeOfIncome | string | Type of income for which recipient claiming the treaty benefits. |

| AdditionalConditions | string | Additional conditions from the tax treaty benefits. |

| Signature | Object | Signature of the recipient. |

| SignerNm | string | Name of the signer. |

| CapacityInWhichActing | string | If the form is signed by an agent on the person behalf, enter the capacity in which they are acting. |

| Errors | Object | Shows detailed error information. |

Sample Response: The recipient has completed Form W-8BEN, and the status has changed to Completed. A webhook notification is sent to clients to inform them of this update. The payload includes a PdfUrl that provides a secure link to download the completed Form W-8BEN.

{

"SubmissionId": "cc8800ac-af79-4dd2-9c5c-89bd84f5ba5c",

"WebhookRef":"99db0874-e749-48d6-b96f-de6447d03667",

"Requester": {

"BusinessId": "ecef4552-34cf-4b65-aae8-ac74bc1ec484",

"PayerRef": "Pay140054",

"BusinessNm": "Snowdaze LLC",

"FirstNm": null,

"MiddleNm": null,

"LastNm": null,

"Suffix": null,

"TINType": "EIN",

"TIN": "XX-XXX8383",

"DBAId": null,

"DBARef": null

},

"PayeeRef": "abc123",

"RecipientId": "ef19604c-6797-461e-9b16-73212c131e4a",

"W8BENStatus": "COMPLETED",

"StatusTs": "2024-07-30 03:33:04 -04:00",

"FormW8BENRequestType": "URL_API",

"PdfUrl": "https://s3.amazonaws.com/taxbandits-sb-api/e215d180-6803-4306-81ac-70f82b6f7034.Pdf",

"Email": null,

"FormData": {

"NmOfIndividual": "Shawn Willams",

"CitizenOfCountry": "Canada (CA)",

"USTINType": "SSN",

"USTIN": "723-67-2388",

"ForeignTIN": null,

"IsFTINNotLegallyRequired": true,

"ReferenceNum": "76895",

"DOB": null,

"ExpiryDate": "05/01/2028",

"PermanentAddress":{

"Address1": "120 Bremner Blvd",

"Address2": "Suite 800",

"City": "Toronto",

"ProvinceOrStateNm": "Ontario",

"Country": "Canada",

"PostalCd": "4168682600"

},

"MailingAddress": {

"Address1": "120 Bremner Blvd",

"Address2": "Suite 800",

"City": "Toronto",

"ProvinceOrStateNm": "Ontario",

"Country": "Canada",

"PostalCd": "4168682600"

},

"TaxTreatyBenefits": {

"BeneficiaryCountry": null,

"ClaimingProvArticlePara": null,

"RateOfWH": "0.0",

"TypeOfIncome": null,

"AdditionalConditions": null

},

"Signature": {

"SignerNm": "Shawn Willams"

}

},

"Errors": null

}

Sample Webhook Response: The recipient has completed Form W-8BEN, and the status has been changed to “Expired.” It will be notified to clients via Webhook.

{

"SubmissionId": "dbeb2b22-ab08-4650-a6ab-e3ef1719c11c",

"WebhookRef": null,

"Requester": {

"BusinessId": "719a1a65-e3f1-46ca-9043-6d2d4e573958",

"PayerRef": "PR001",

"BusinessNm": "Snowdaze LLC",

"FirstNm": null,

"MiddleNm": null,

"LastNm": null,

"Suffix": null,

"TINType": "EIN",

"TIN": "43-7278383",

"DBAId": null,

"DBARef": null

},

"PayeeRef": "Pe8332",

"RecipientId": "490767c0-5278-452d-b21f-82a021f3522c",

"W8BenStatus": "EXPIRED",

"StatusTs": "2025-04-10 00:01:38 -04:00",

"FormW8BenRequestType": "URL_API",

"PdfUrl": null,

"Email": null,

"FormData": null

}