Upon this request, a secure URL to complete and e-sign W-9 Forms has been sent to the respective vendors. Once they were done, the payers were notified through Webhooks, and the completed W-9 forms were made available in the software for them to access.

Understanding W-9 Automation

W-9 automation helps you streamline and digitize the collection of W-9 Forms from your vendors/gig workers/affiliates/independent contractors and ensure accurate 1099 filings. Here is how W-9 automation works:

- Collect W-9s from the vendors during their onboarding or post-boarding via email or embedded secure URL.

- Validate the data collected and perform TIN Matching to ensure the SSN/EIN matches the IRS database.

- Use these data to generate 1099s at the year-end, e-file them with the

IRS & state, and distribute the copies.

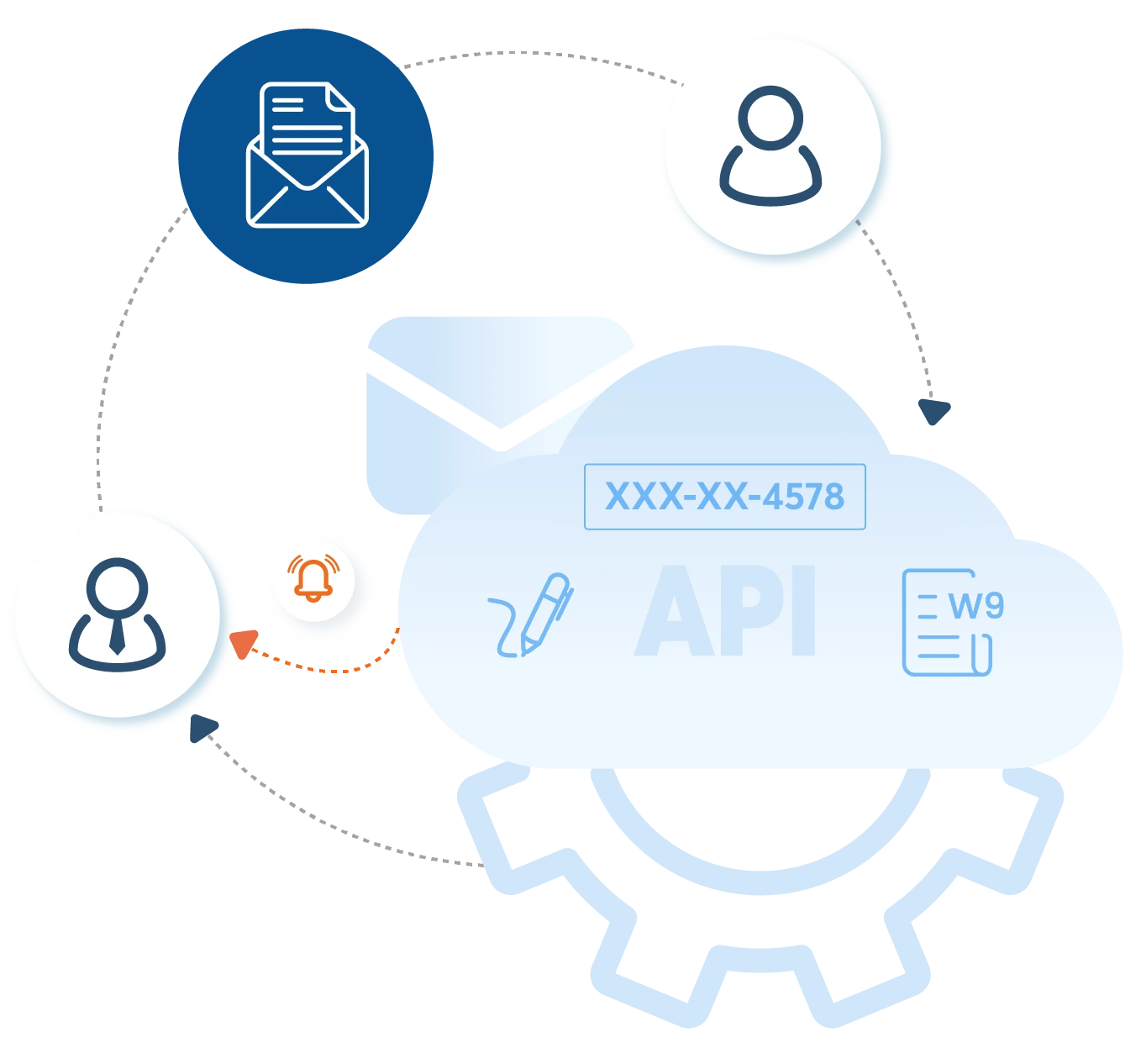

TaxBandits API W-9 Automation Workflow

Data Collection

Collect the W-9s from the vendors using the payer-initiated or payee-initiated method or the Drop-in UI.

Validation

TaxBandits performs TIN Matching, Address Validation & Data Validation to

promote accuracy.

1099 E-Filing & Distribution

The W-9 data will be used to automate the e-filing and distribution of 1099 forms at

the year-end.

Ready to automate W-9?

Get Started NowHow TaxBandits API Automates W-9?

There are three different methods for automating the W-9 process with TaxBandits API.

Payer Initiated (RequestByEmail) Workflow

The payers will request the vendors to complete and submit W-9 Forms via email. Here is how it works:

- Using our API endpoint, the payer sends the vendor (payee) a request to complete Form W-9 via email.

- The vendors will receive an email with a link to complete Form W-9.

- After the vendor completes and e-signs the W-9, TaxBandits will validate the information and notify the payer.

Popular Use Case:

Accounting/CRM Software can use this method to collect W-9 Forms from their vendors, gig workers, and affiliates by email.

Payee Initiated (RequestByUrl) Workflow

The vendors will initiate the W-9 completion process themselves upon clicking a secure URL. Here is how it works:

- TaxBandits will generate a secure URL for completing W-9 based on the unique identifier of the vendors (Eg: vendor id).

- Payers that provide a self-guided onboarding process for their payees can embed the secure URL into their portal/page.

- Once the vendors complete and e-sign the W-9 using the secure URL, TaxBandits will do the validation and notify the payers.

Popular Use Case:

If you provide your vendors with a Portal for self-guided onboarding, this method allows them to complete W-9 during their onboarding process instead of sending them an email.

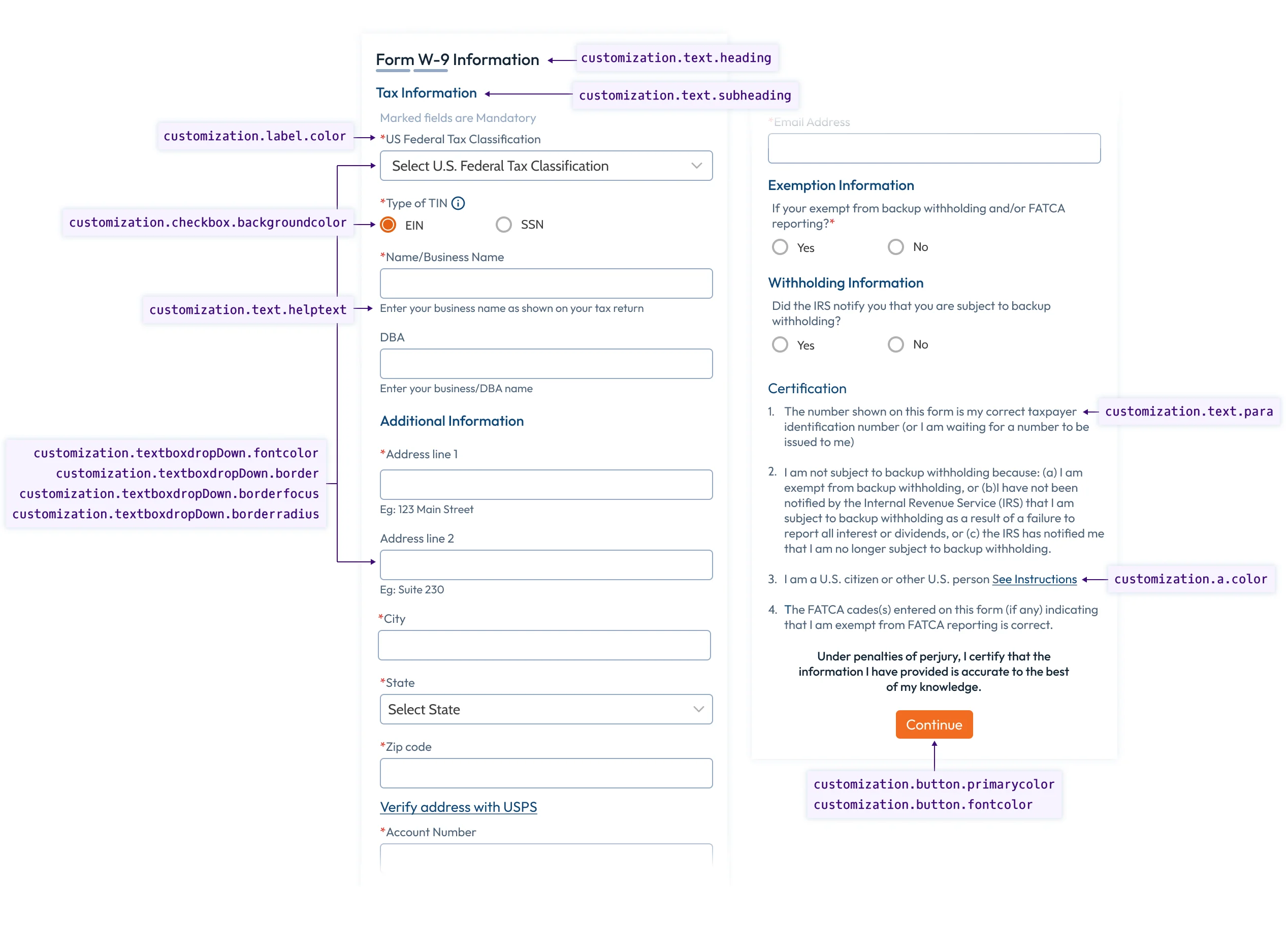

Drop-in UI for Form W-9

TaxBandits offers a Drop-in UI for Form W-9 that can be customized and integrated quickly into your software or portal.

- Our Drop-in requires minimal effort to set up and leverages HTML, JavaScript, and Bootstrap for styling.

- You can customize every aspect of the secure URL (W-9 completion page), from URL to theme, to align with your branding.

Develop with Confidence!

TaxBandits API allows for seamless integration, end-to-end testing, and simulations with the

guidance of comprehensive documentation.

W-9 Automation Success Stories with TaxBandits API

A leading Accounting Software company replaced its manual W-9 collection process with TaxBandits API. Their clients can now request W-9s from their vendors directly from the software in just a few clicks.

A popular Affiliate software program that offers affiliate marketing programs and acts as a middleman between these merchants and affiliates uses TaxBandits API to automate their W-9 collection from contractors and gig workers. This provides them with a simple and efficient solution for accurate 1099 filing.

By integrating TaxBandits API, they have enabled the automation of W-9 collection during the onboarding process of the affiliates. The W-9 data collected were securely stored in TaxBandits, and at the end of the year, TaxBandits automated the 1099 filings using those data and the payout transactions recorded throughout the year.

A large Gig Economy Company that connects gig workers and contractors with builders over a platform integrated TaxBandits into their software to automate the process of collecting W-9 Forms and e-filing 1099 Forms.

A secure URL generated by TaxBandits has been embedded in the contractors' onboarding page of their software. Upon clicking the URL, the contractors were provided with a secure portal to complete and e-sign the W-9s. Using those W-9 data and the payout transactions recorded, TaxBandits has automated the 1099 filings at the year-end.

Frequently Asked Questions about

W-9 Automation

1. What are the customizations allowed by TaxBandits API in W-9 automation?

TaxBandits API allows you to customize various aspects of W-9 automation with your brand.

- Email Customization - The W-9 request emails sent to the vendors can be customized with your brand name, logo, and the ‘From’ email address.

- Secure Url Customization - The form completion page provided to the vendors can be customized with your brand logo. Also, you can customize the redirection URLs when the vendor completes (or) cancels the W-9 process.

- Webhooks Customization - The kind of details you receive through Webhooks can be customized. For example, you can request not to include PII data (Eg: TIN) in Webhook notifications.

2. How will I get notified when the vendor completes a W-9?

When a vendor completes and e-signs their W-9, TaxBandits will notify you through Webhooks. The webhook payload will include the W-9 data as well as the link to download the completed form. Also, if you have opted for TIN Matching, you can get the status of TIN Matching of the W-9s through Webhooks.

For more information, click here.

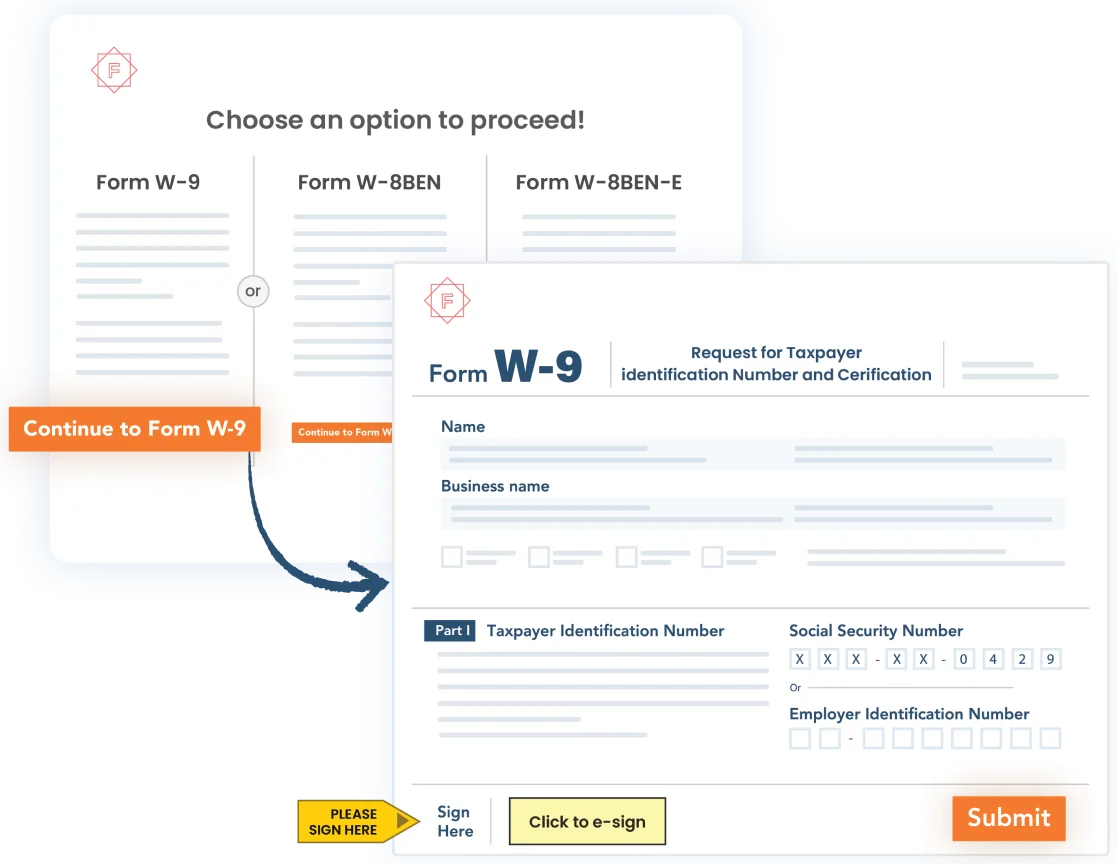

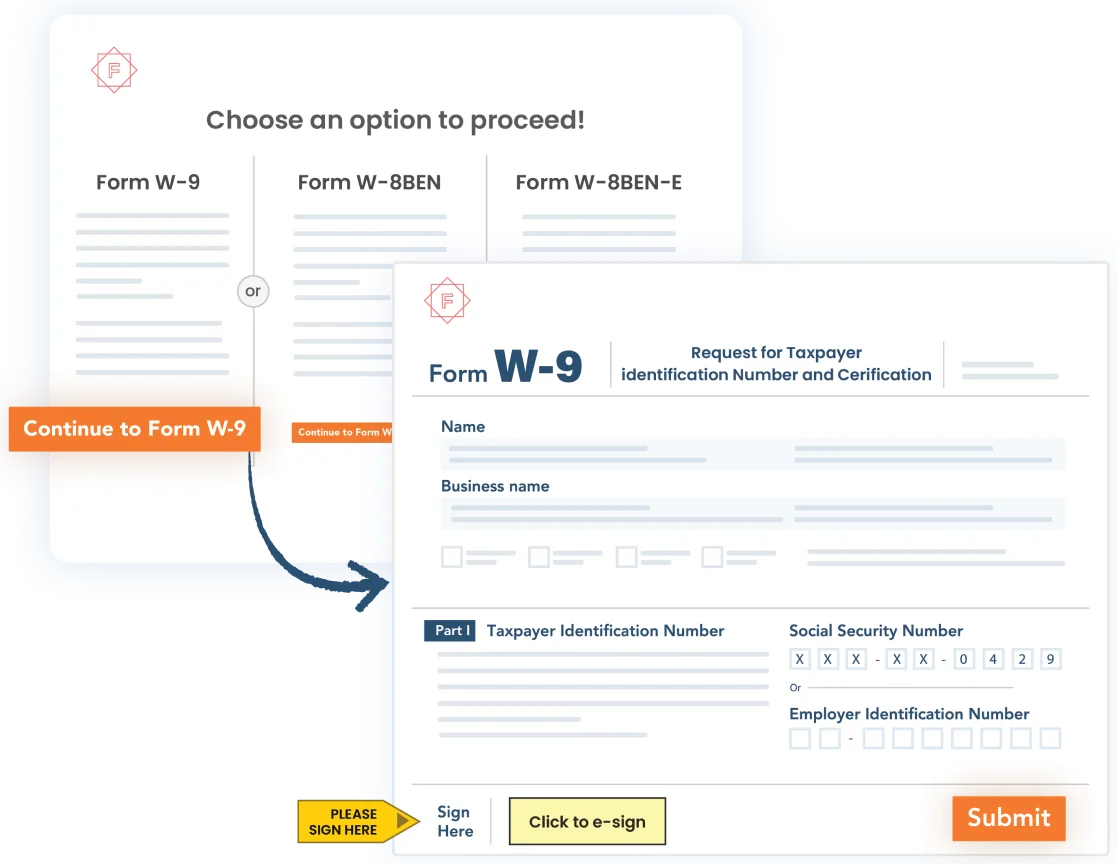

3. Is there a way to allow my vendors to choose between W-9 and W-8 based on their citizenship status?

Yes! By using the API endpoint WhCertificate, you can enable your vendors to choose between W-9, W-8BEN, and W-8BEN-E and complete the Form that is applicable to them.

Click here to see how it works.

4. Can I simulate the TIN Matching process in SandBox?

Yes! You can simulate the TIN matching process in Sandbox to see how it works.

If you provide any TIN that ends with 000, the TIN Matching status for the respective W-9 will be shown as failed.