Why Should You Integrate TaxBandits API with Your

HCM Software?

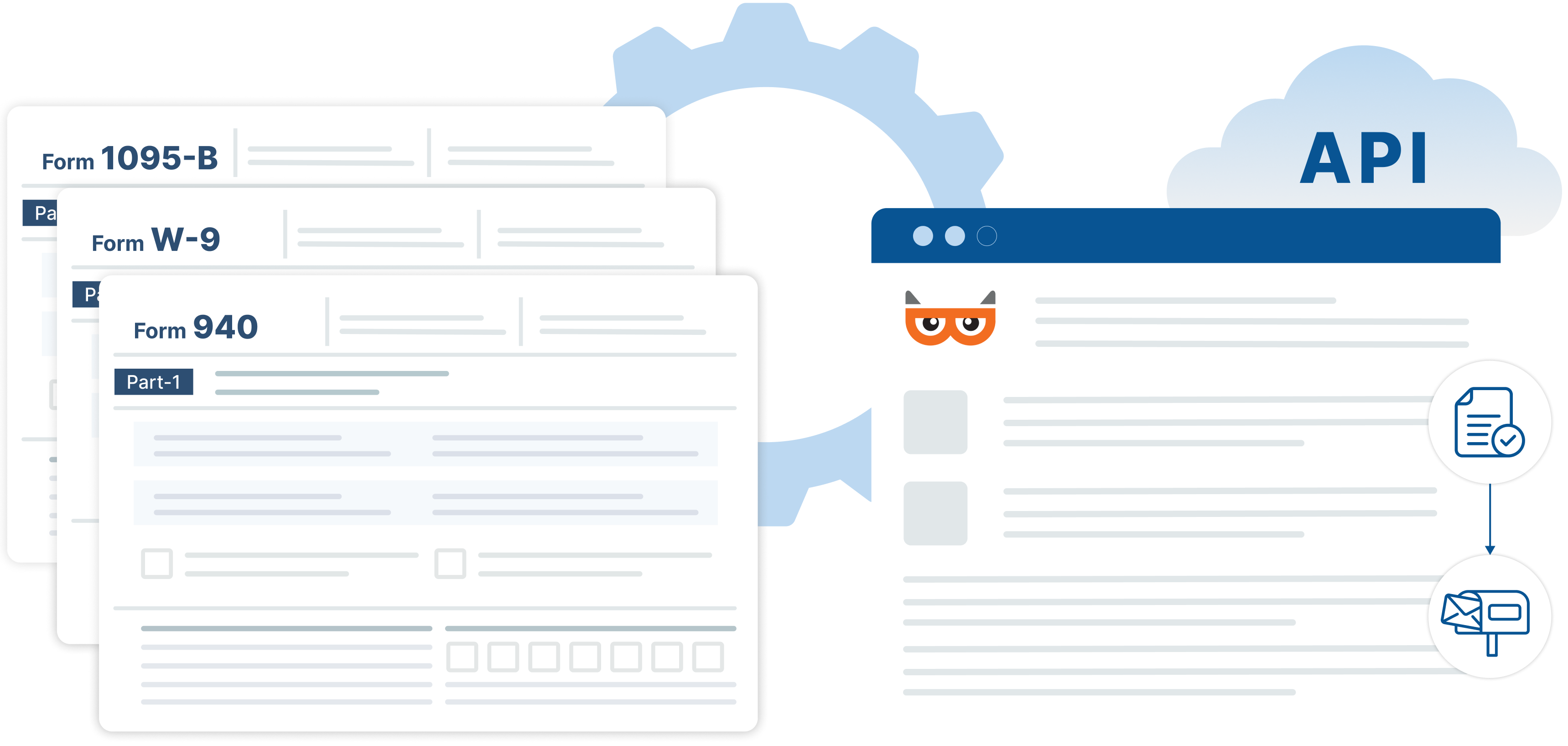

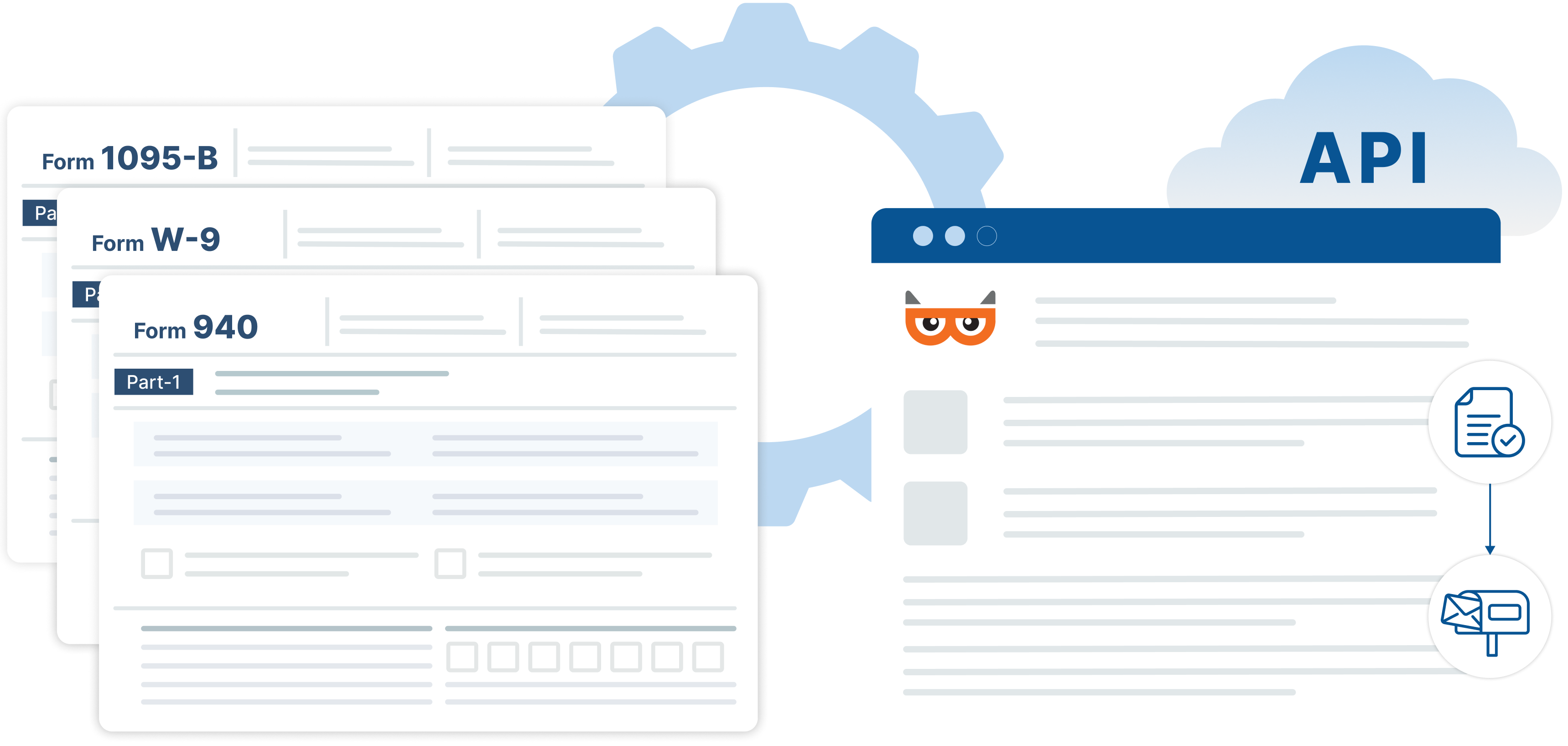

- Our API lets you discover a seamless way to prepare and manage payroll filings within your software.

- Just send us the filing data through API endpoints, and let us take care of the preparation and e-filing of forms.

- With TaxBandits API, you can meet the tax filing requirements with both federal and

state agencies. - You can opt to distribute the form copies to the recipients via Postal Mail or Online Access.

- Integrating our API not only lets you ensure tax compliance but also enables you to broaden your revenue channels.

Common Tax Forms that HCM Providers File

ACA Form

1095-B/C

Used to report details about the health coverage offered to employees/individuals.

Form W-2

Used to report the annual wages paid to employees and taxes withheld from their paychecks.

Form 940

Used to report the annual Federal Unemployment (FUTA) Taxes withheld from employee wages.

Form 941

Used to report Income taxes, Social Security tax, and Medicare taxes withheld from employee wages.

TaxBandits supports the e-filing of all major tax forms,

click here for a complete list.

Exclusive Tools and Features that Developers Can Rely on!

TaxBandits’ developer-friendly API offers various helpful resources and tools exclusively for developers, enabling seamless integration.

Comprehensive Documentation

Our documentation comprises detailed instructions with sample requests and responses for each endpoint, offering complete guidance.

SDKs

We offer open SDK libraries in Java, Node JS, Dot Net & Python to help you use our API and develop with complete ease.

Sandbox

Our Sandbox offers you a secure environment to confidently develop and test each and every aspect of

the API.

Simulation

In Sandbox, you can simulate the end-to-end e-filing process, form status, and various other processes to see how

they work.

Advanced Security

We incorporate standard security protocols that ensure the complete security of all sensitive information.

Developer Support

In case of any queries related to the API, you can get instant help from our expert team

of developers.