Understanding 1099 Automation

1099 automation transforms the way you manage 1099 filings. It streamlines every aspect of the process, from form preparation to e-filing and distribution, eliminating the need for manual effort and paperwork. With 1099 automation,

you can:

- Effortlessly collect W-9 forms from vendors, affiliates, and

gig workers. - Track payout transactions made throughout the year with ease.

- Generate and validate 1099 forms automatically, based on W-9 data and payouts, for

e-filing with the IRS and states. - Distribute 1099 forms to recipients via postal mailing or secure

online access.

Getting started with TaxBandits API for 1099 automation

Develop

Create a free sandbox account to start integrating our 1099 API with your system.

Test

Run an end-to-end simulation of the 1099 API in the sandbox to ensure seamless operation.

Deploy

Move your API integration to live and automate 1099 filing and distribution effortlessly.

A closer look at 1099 automation with TaxBandits API

Collect W-9/W-8

- Use our API to effortlessly automate the collection of W-9 forms from vendors, affiliates, and gig workers. We also support

W-8 BEN, W-8 BEN-E, and W-8 ECI forms for

non-U.S. residents. - TaxBandits will validate the collected data using TIN Matching to ensure

the accuracy. - All collected data will be securely stored, ensuring data protection and instant access for

future filings.

Learn more about W-9 automation

Record & track transactions

- Record and track all the payouts made to your vendors, gig workers, or affiliates in our system throughout the year using our 1099Transactions API.

- Our system lets you upload all the transactions of multiple recipients in bulk, ensuring faster processing.

- You can retrieve a detailed list of all recorded transactions, easily review and edit them as needed, before filing.

Automate 1099 e-filing at the year-end

- Use the GenerateFromTxns endpoint for the corresponding 1099 form to have TaxBandits automatically generate 1099 forms based on the transactions you've recorded.

- You can easily review the forms, make any necessary adjustments, and approve them

for transmission. - Once you've reviewed and approved your 1099 forms, TaxBandits will handle the e-filing process with the IRS and State, ensuring compliance and accuracy.

Note: If you haven't recorded transactions, you can directly create 1099 forms and let us transmit them to the IRS and states.

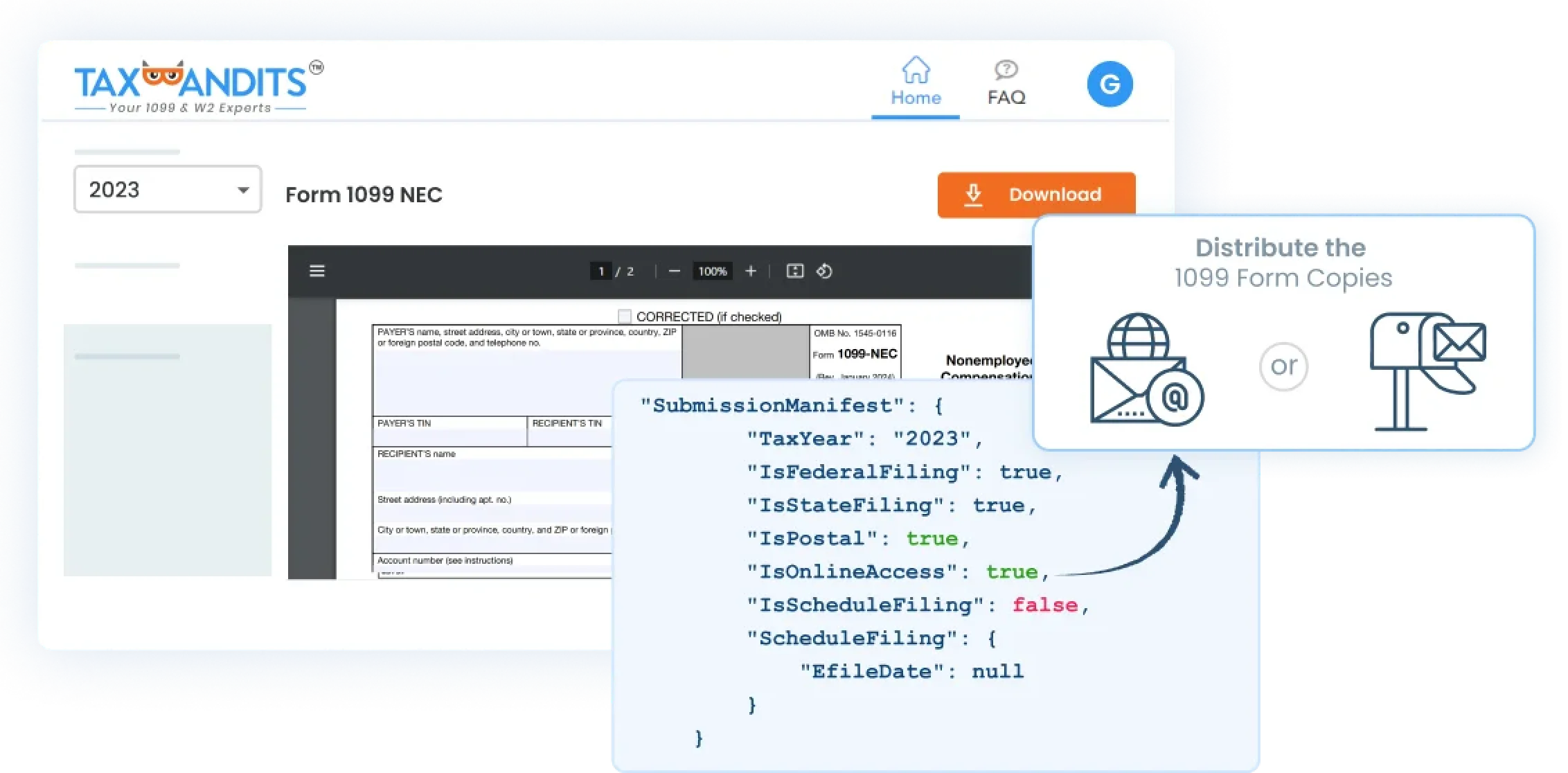

Distribute 1099 copies

- While generating or transmitting your 1099 forms, you can opt for our Postal Mailing option to send physical 1099 copies to your recipients.

- If you choose to distribute the copies electronically, you can opt for the Online Access service. Recipients will receive an email with a link to access their 1099 forms through a secure portal.

Need to send any additional documents to recipients?

TaxBandits allows you to upload relevant attachments, such as payment receipts or transaction-related documents, to be included with the 1099 form copies in the

postal mailing.

Additional features that enhance your 1099 automation

Powerful tools designed to ensure accuracy, streamline processes, and give you full control over your 1099 filing—every step of the way.

1099 Corrections

Mistakes do happen, but we make it easy to fix them. If you find any mistakes on your 1099s after transmission, easily file corrections with our API.

Rejection Handling

If the IRS rejects your 1099 due to errors, we guide you to correct them and retransmit without any additional charges.

Webhook Notifications

Stay in sync with instant Webhook updates regarding the IRS status of your 1099 forms, eliminating the need for manual follow-ups.

Develop with Confidence!

TaxBandits’ developer-friendly API allows for seamless integration, end-to-end testing, and simulations.

Implement TaxBandits API efficiently with the help of our

comprehensive documentation.

1099 Automation Success Stories with TaxBandits API

A Ridesharing start-up that offers on-demand scheduled delivery services to individuals and businesses integrated TaxBandits API with their software.

Show more

A popular creator-economy company that offers a live video streaming platform for numerous content creators integrated TaxBandits API with their software to streamline tax filings.

Show more

Serving as an intermediary platform for thousands of gig workers and businesses, a leading Gig Economy Company chose TaxBandits API integration to manage their tax compliance. Show more

Frequently Asked Questions about 1099 Automation

What if I haven’t recorded my transactions? Can I still file 1099 forms?

Yes! If you haven't recorded transactions, you can still create and transmit 1099 forms directly through the TaxBandits API.

Learn more

How secure is the transaction data I upload?

TaxBandits uses industry-standard encryption and security protocols to protect your data, ensuring that all sensitive information, including W-9 forms and payment details, is stored securely.

How will I be notified when copies of W2/1099 are postal mailed to recipients?

You can configure the Postal Sent Webhook to receive a Webhook notification when the Postal Mail you opted for W-2/1099 forms are delivered to the recipients.