Using our integration, they were able to collect W-9s from their drivers during the onboarding process and record payout transactions made to drivers throughout the year. At the end of the year, TaxBandits automated the e-filing of all of the required 1099 forms with the IRS and States based on the W-9 data and payouts. Then, TaxBandits securely distributed 1099 copies to their drivers.

Understanding 1099 Automation

Integrating 1099 API simplifies the preparation and e-filing of 1099 Forms at the end of the year with the following steps:

- Collect W-9 Forms from vendors, affiliates, and gig workers.

- Record the payout transactions made throughout the year.

- Based on the W-9 data and payouts, the 1099 Forms will be generated, validated, and e-filed with the IRS and State.

- The 1099 Form copies will be distributed to the recipients via Postal Mailing or Online Access.

The 1099 Automation Process with TaxBandits API

Develop

Get started with TaxBandits API and create a Free Developer Sandbox Account

Test

Test and deploy APIs in a sandbox to ensure smooth integration.

Deploy

Integrate APIs seamlessly into your applications to take advantage of the features and drive innovation.

A Closer Look at How TaxBandits API Automates

the 1099 Process

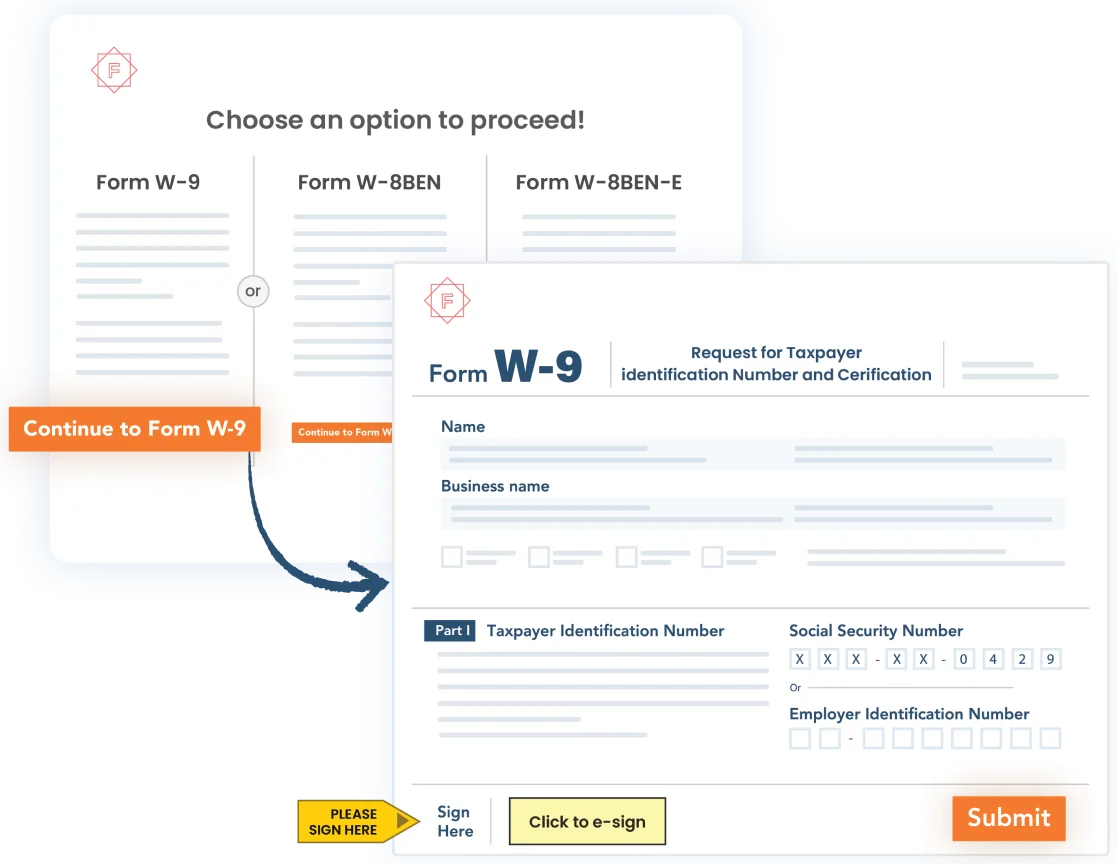

W-9 Collection

- TaxBandits API automates the collection of W-9 forms.

- Once vendors have completed their W-9s, TaxBandits performs TIN Matching to ensure the TINs match the IRS database and stores the information securely.

- TaxBandits API also supports the W-8BEN/W-8BEN-E form for non-residents of the U.S.

Click here to learn more about W-9 Automation.

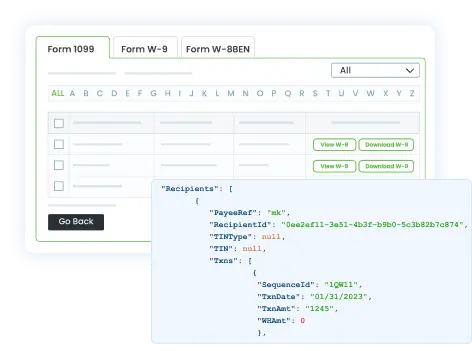

Record & Manage Payouts Conveniently

- With TaxBandits 1099 Transaction API, you can record and keep track of all your vendor, gig worker, and affiliate payments made throughout

the year. - You can also upload the transactions in bulk, and the uploaded data can be synced with your system.

- Once uploaded, you can organize the transactions under the appropriate 1099 forms.

Let TaxBandits Take Care of 1099 E-filing

- TaxBandits creates 1099s according to IRS Business Rules based on W-9 information and payment information and validates the data for accuracy.

- You can preview the 1099 forms and make changes if necessary, then approve them.

- Once you approve the 1099 forms, you can e-file them with the IRS and the states. We also support state-only filing.

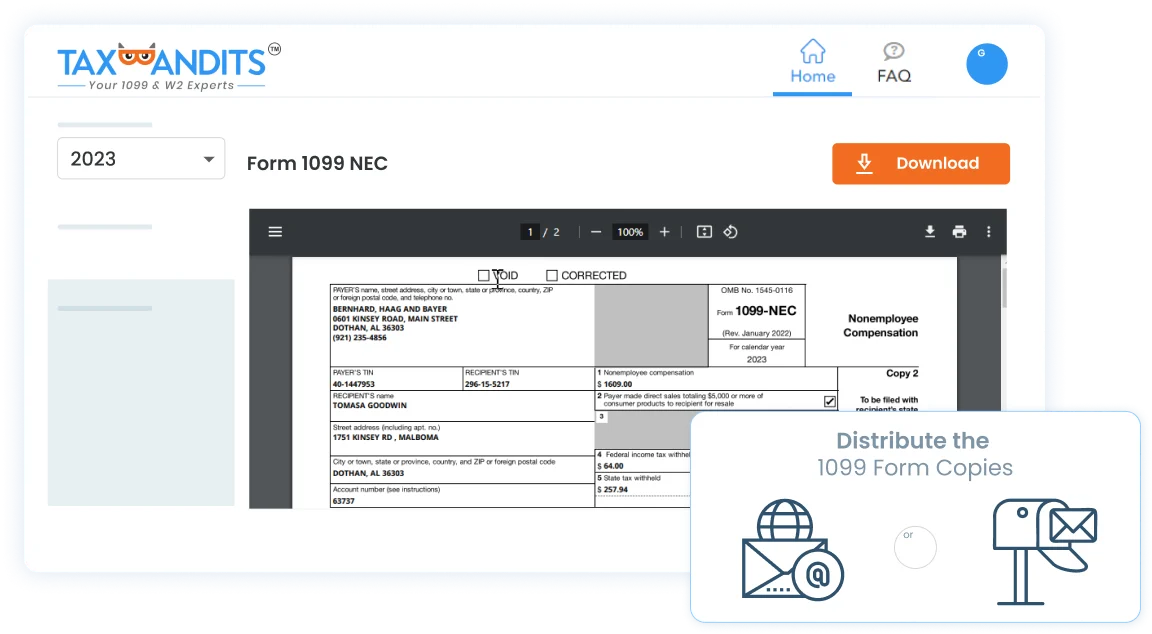

Distribute the 1099 Form Copies

- You can opt for our postal mailing service to send copies of Form 1099 to vendors and gig workers, as well as to your affiliates.

- You can also send electronic forms to all eligible recipients through TaxBandits secure online access portal.

Develop with Confidence!

TaxBandits’ developer-friendly API allows for seamless integration, end-to-end testing, and simulations. Implement TaxBandits API

efficiently with the help of our comprehensive documentation.

1099 Automation Success Stories with TaxBandits API

A Ridesharing start-up that offers on-demand scheduled delivery services to individuals and businesses integrated TaxBandits API with their software.

A popular creator-economy company that offers a live video streaming platform for numerous content creators integrated TaxBandits API with their software to streamline tax filings.

Our API has enabled them to manage every aspect of their tax compliance directly from their software. This starts with collecting and managing their content creators’ W-9 information. They were then able to complete their year-end 1099-K e-filing with the IRS and State(s). Finally, based on their recipient’s consent, TaxBandits distributed the 1099-K copies via Postal Mailing and secure Online Access.

Serving as an intermediary platform for thousands of gig workers and businesses, a leading Gig Economy Company chose TaxBandits API integration to manage their tax compliance.

With the TaxBandits API, they automated their W-9 collection process and the e-filing of Forms 1099-NEC, 1099-MISC, 1099-K, and more within their software. TaxBandits has helped them meet both their federal and state filing requirements and manages their recipient copy distribution as well.

Frequently Asked Questions about 1099 Automation

1. Can I download my 1099 Forms with Masked TIN?

Yes! By using the API endpoint GetPDF, you can send a request to download the complete 1099 Form in a PDF format, wherein you can choose to mask the TIN in the PDF for security purposes.

Click here to see how it works.

2. Will I have the option to modify the payouts and transactions recorded?

In case you have recorded an incorrect payout or transaction using TaxBandits 1099 Transaction API, you have the option to delete it and add the corrected information again.

For more information, Click here.

3. One of my 1099 Forms contains incorrect information. Can I file a 1099 Correction

using API?

Yes! TaxBandits API currently allows you to file corrections for 1099-NEC and

1099-MISC Forms by using the corresponding endpoints.

Note: 1099 corrections can be filed only to correct the recipient details such as Name, TIN, and Payments. If you need to correct the payer details, you must send a letter to the IRS containing all the previously reported payer information and the corrected information.

4. How will I be notified when copies of W2/1099 are postal mailed to recipients?

You can configure the Postal Sent Webhook to receive a Webhook notification when the Postal Mail you opted for W-2/1099 forms are delivered

to the recipients.