1099 Compliance for HOAs

- An Overview

- Home Owners Associations (HOAs) are required to file 1099s for reporting the payments they made to the vendors, gig workers, tenants, etc.

- This includes the HOAs that are involved in Property Management, Rental Management & Community

Management, etc.Example: If the HOA has hired a gardener on a contractual basis, they must file 1099-NEC and furnish a copy to the gardener.

Common Tax Forms that

HOAs File!

1099 NEC

To report the payments made to non-employees (contractors, freelancers, etc.)

1099 MISC

To report the miscellaneous payments made

(rents, awards, etc.)

1099-K

To report online card transactions and third-party network transactions made.

How TaxBandits API Helps HOAs Ensure Tax Compliance

Integrating TaxBandits API with your HOA software allows you to enable an easy and

secure way to ensure tax compliance right from your software.

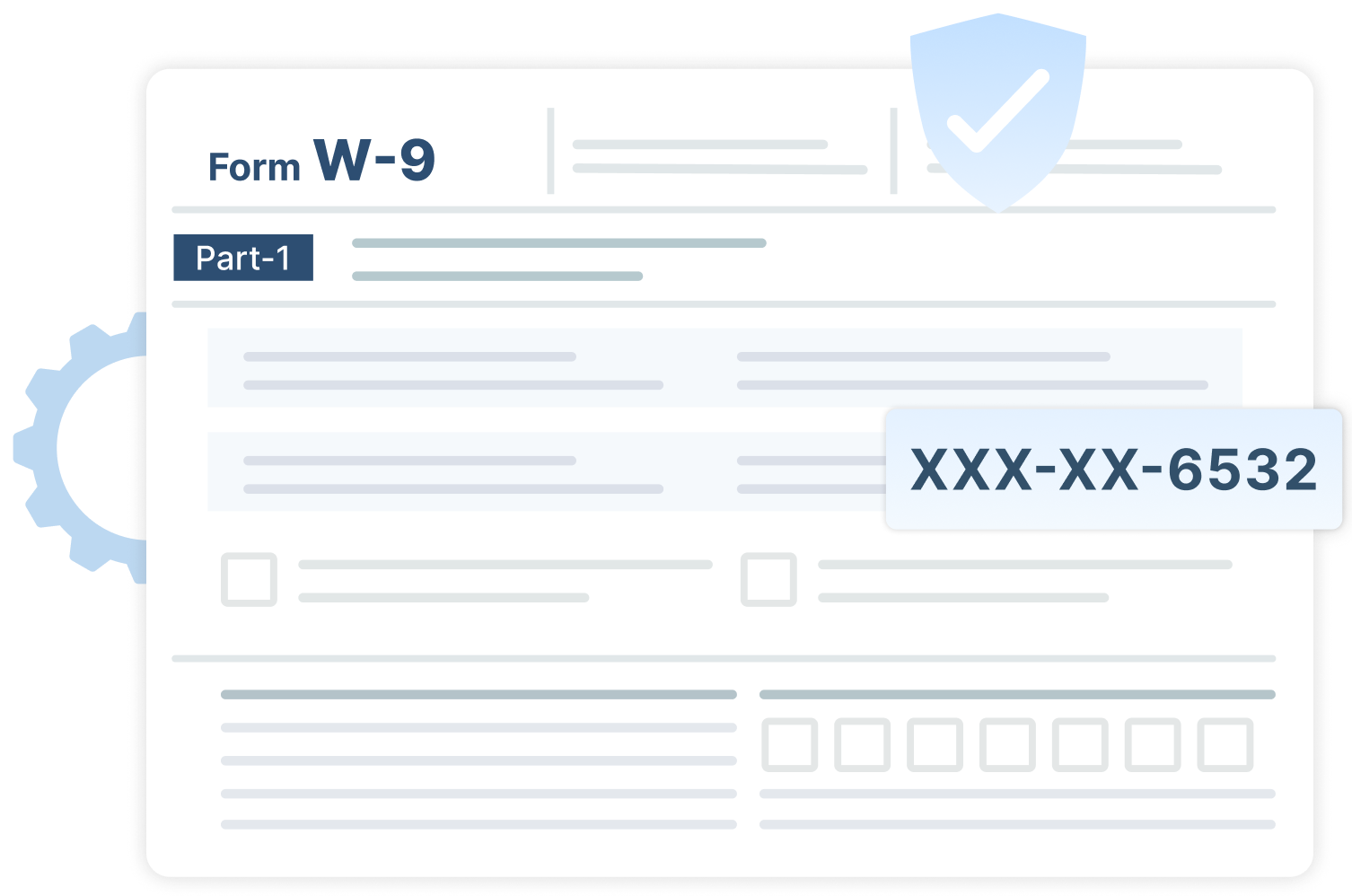

W-9 Automation

- Use our API to automate the collection of W-9s from vendors, gig workers, tenants, etc., via Email or an embedded

Secure URL. - TaxBandits performs TIN Matching to ensure the TINs obtained match the

IRS Database. - These W-9 data will be securely stored in TaxBandits and utilized later for

1099 filing.

1099 Automation

- Let TaxBandits automate your 1099s at the year-end based on W-9 data and the payouts you recorded throughout the year.

- We support the e-filing of 1099s with both the IRS and respective State agencies.

- You can also distribute the 1099 copies easily via Postal Mail (or) secure

Online Access.

Other Tax Filings

Apart from the 1099s, TaxBandits supports many other major tax forms,

such as,

- Form W-2

- Form 940, 940 Schedule R

- Form 941, 941 Schedule R

- ACA 1095 Form

Develop with Confidence!

TaxBandits’ developer-friendly API offers various helpful resources and tools exclusively for

developers, enabling seamless integration.

Comprehensive Documentation

Our documentation comprises detailed instructions with sample requests and responses for each endpoint, offering complete guidance.

SDKs

Our Open Software Development Kit (SDK) libraries are available in Java, Node JS, .Net, & Python, explaining how to use our API.

Sandbox

You can use our Sandbox environment to develop and test the integration securely. You can even simulate the complete e-filing process

as well.

Webhooks

With the application of Webhooks, TaxBandits API provides you with updates on the status of the tax returns filed.

Advanced Security

We incorporate standard security protocols that ensure the complete security of all sensitive information.

Developer Support

We have an expert team of developers available to address and resolve your API-related questions,

if any.