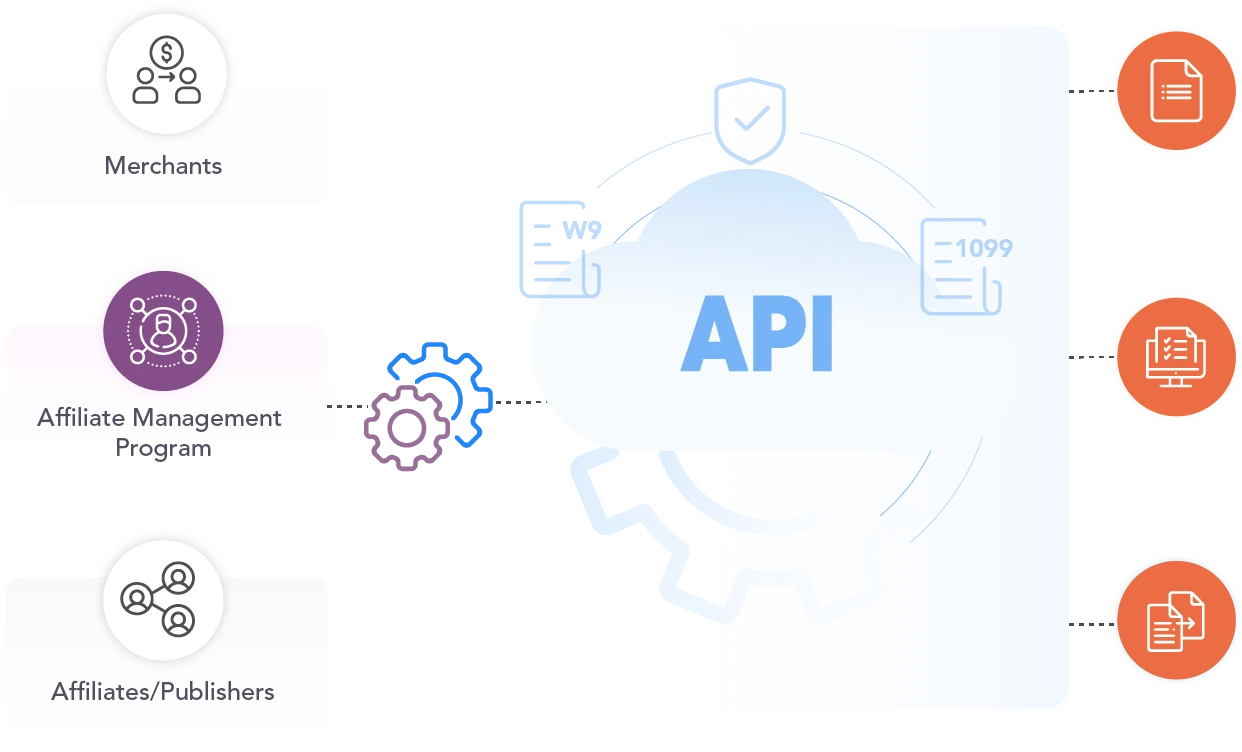

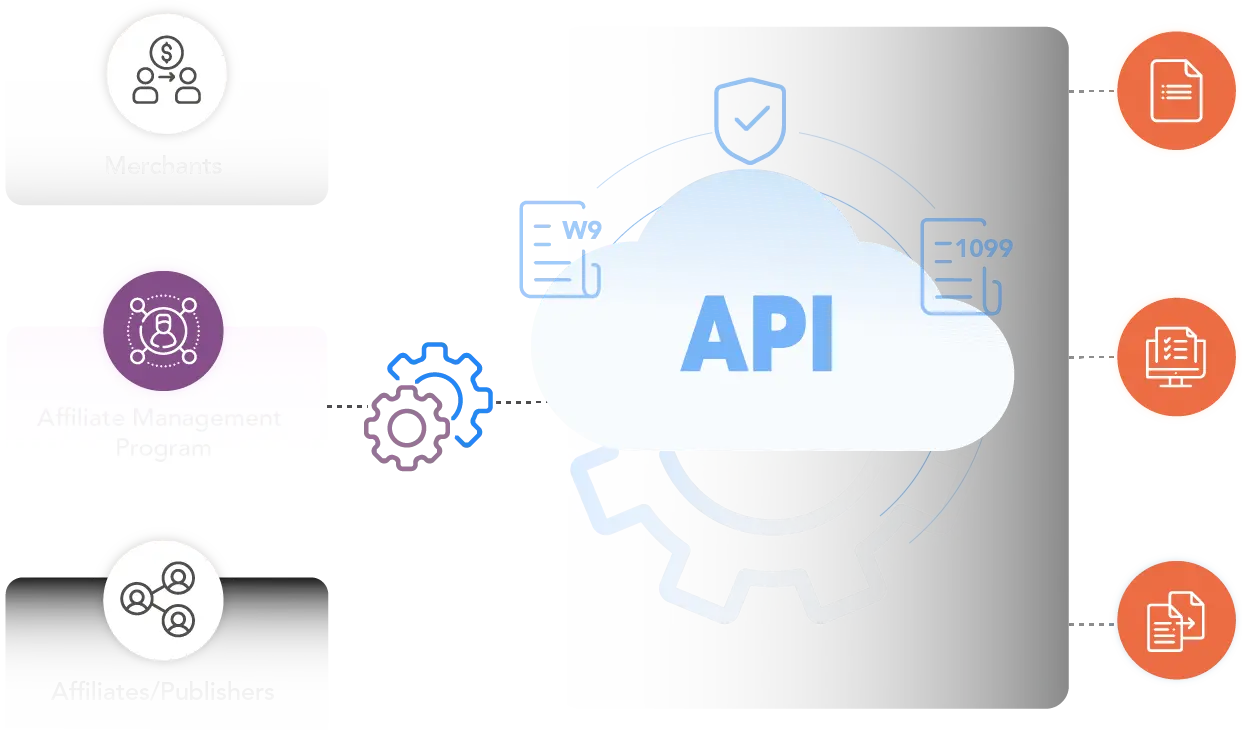

Using their API endpoints, TaxBandits collected W-9 Forms from affiliates during onboarding, tracked their payments, and generated year-end 1099 Forms. Merchants then reviewed and approved forms before IRS and state transmission. Then, TaxBandits distributed their recipient copies via postal mail.

How Affiliate Marketing Programs Benefit from

TaxBandits API?

W-9 Collection and TIN Matching

Securely collect and manage W-9s from your affiliates/publishers while our system ensures accuracy through TIN Matching.

1099 Filing with IRS and States

Let TaxBandits accurately generate and e-file the 1099 forms with IRS & states at the year-end.

Distribution of 1099 Copies

Distribute the copies of 1099 forms to the recipients using either TaxBandits Postal Mailing or Online Access.

Ready to Get Started with TaxBandits API?

Get Started NowBest Fit for All Type of Affiliate Management Programs

TaxBandits API provides a tax compliance solution for all types of Affiliate Management Programs.

- Collect the W-9s easily and securely during the onboarding process of both the merchants and the affiliates/publishers.

- Use our 1099 transaction API to record the payouts made to the affiliates/publishers throughout the year.

- TaxBandits generates the 1099 forms at the year-end. Based on the responsibility of filing 1099 forms, either you or your merchants can preview and approve the 1099 returns.

Tax Compliance for Affiliate Management Programs

TaxBandits supports the e-filing of all the major tax forms. For the complete list of forms, Click here.

Form 1099-K

Used to report payments through payment cards, payment apps, or online marketplaces (third-party payment networks).

Form 1099-MISC

Used to report the miscellaneous payments (Eg: rents, awards) made to individuals or entities.

Form 1099-NEC

Used to report the non-employee compensation made to contractors, freelancers, gig workers, etc.

Form 1042-S

Used to report payments made to foreign individuals subject to NRA Withholding and Reporting.

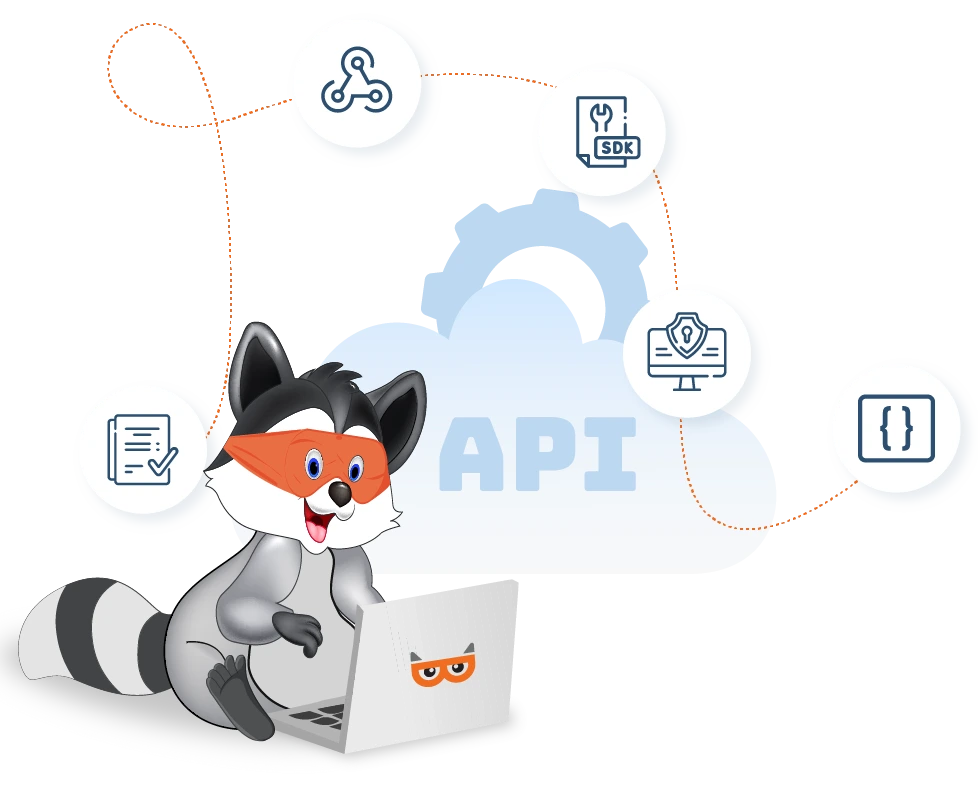

Exclusive Tools and Features that Developers Can Rely on!

Clear Documentation

Comprising detailed instructions with sample requests and responses for each endpoint, our documentation can help you develop with confidence.

SDKs

Our open Software Development Kit (SDK) libraries explain how to use TaxBandits API in major programming languages such as Java, Node JS, .Net, and Python.

Sandbox

You can develop and test the integration and perform a complete simulation of the e-filing process seamlessly within the Sandbox environment.

Webhooks

Our API will provide status updates through Webhooks regarding every aspect of the W-9 process and the tax filings.

Advanced Security

TaxBandits API incorporates high-standard security protocols that ensure complete protection of all sensitive information.

Developer Support

We have an expert team of developers readily available to answer any API-related questions you may have throughout the process.

Success Stories with TaxBandits API

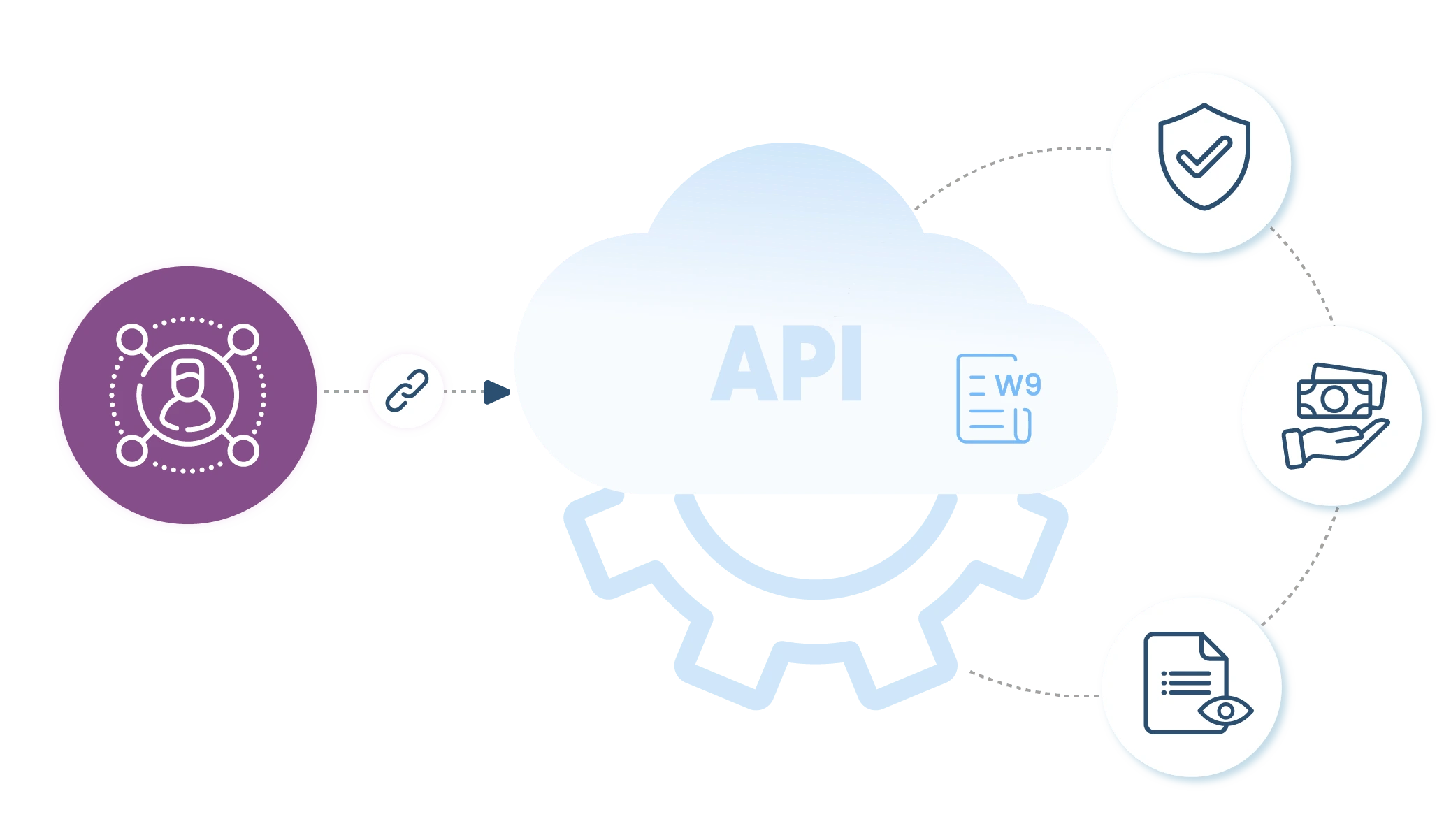

A leading Affiliate Management Program that acts as an intermediary between thousands of merchants and affiliates chose TaxBandits to automate their process of e-filing 1099 Forms.

A prominent Creator Economy company that offers a live video streaming platform for diverse content creators integrated with TaxBandits API to streamline their W-9 collection and 1099 filing processes.

Leveraging our API, they managed all tax compliance within their software. This involved securely collecting and managing W-9 forms during onboarding for merchants and content creators, recording payouts, and effectively filing year-end 1099s with the IRS and states. TaxBandits also facilitated recipient copy distribution via Postal Mailing and Online Access.

A well-established Affiliate Marketing Software, partnering with over 4,000 merchants, chose TaxBandits API to streamline their tax filings for publishers and affiliates.

By integrating with our API, the software enabled its publishers to submit their W-9 information upon sign-up. Payouts received throughout the year were recorded. This data was used to automate 1099 e-filing and distributing copies to publishers at the end of the year.