Overview

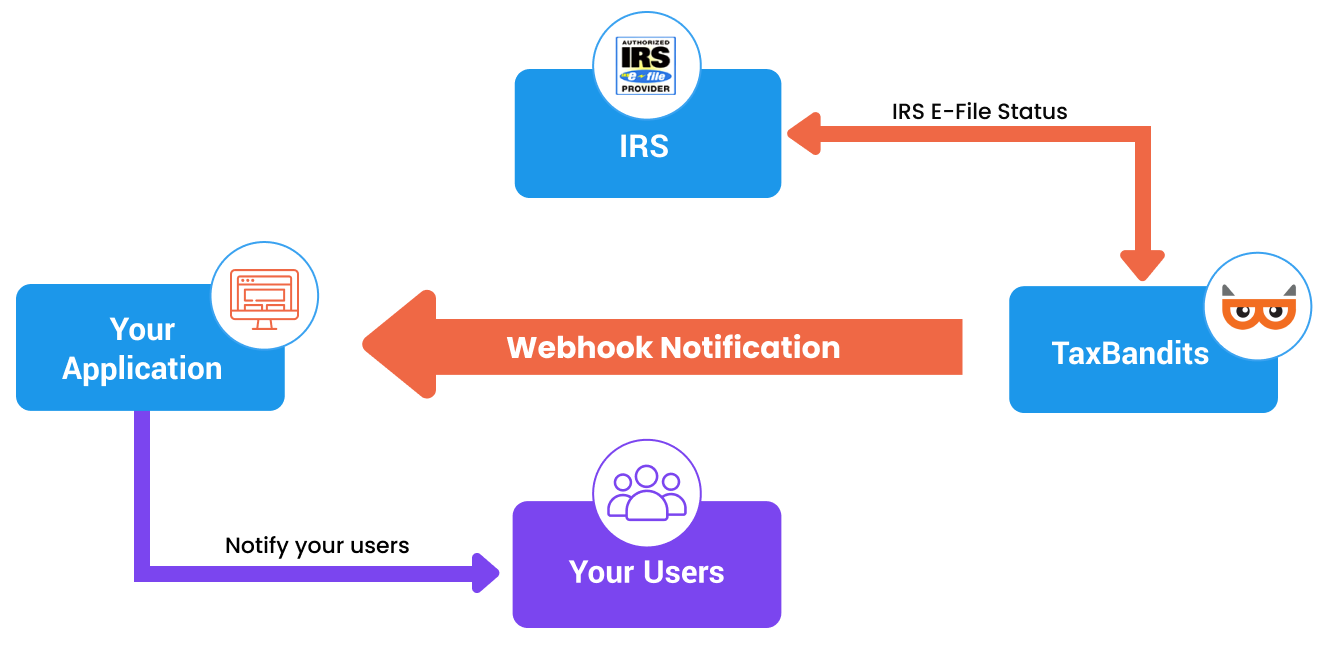

Tax filing is a long-running process, and it can be difficult to keep track of your filings. To simplify this process for you, the TaxBandits API uses Webhooks, allowing you to track your filing statuses efficiently.

Webhook Configuration

In order to use Webhooks in TaxBandits API, you must configure Webhooks in the Developer Console site. You can follow the steps below to configure Webhooks:

- Log in to the Developer Control Panel. Navigate to Settings >> Webhook Notifications

- Click the Add Webhook button and choose the Event Type you prefer. Select Event Type to know the list of events supported.

- Enter the callback URL and click on the Submit button. You must ensure that the callback URL you enter is valid, as the API will authenticate this URL by posting a sample JSON. The URL will be activated only when we receive a 200 response. You must follow these best practices to have a valid callback URL for Webhook.

- Then, provide a Notify email. TaxBandits will use this email to notify you regarding any failed attempts of Webhook posting.

Best Practices to Have a Valid Callback URL for Webhook

- SSL Certificate - The URL you provide must have a valid SSL certificate, i.e., TaxBandits API accepts only HTTPS URLs.

- IP Whitelisting - It’s important that you whitelist our IPs from which the Webhooks will be sent to avoid unauthorized access to the callback URLs.

- Frequent Testing - Frequently, you can send a test notification from our Sandbox console to the callback URL and make sure it is active.

Note: To understand how the Webhook process works, you can make use of Webhook testing sites such as Webhook.site, PostBin, RequestBin, etc.

Webhook Event Types

You can set up Webhooks for the following events:

-

E-File Status Change

You will be notified when the federal agency accepts or rejects your tax form. Learn More -

E-file State Status Change

You will be notified when the state agency accepts or rejects your tax form. Learn More -

Online Access Status Change

You will be notified when the recipient copies (1099, W-2, etc.) are shared via online access, when recipients provide consent, and when they access the forms. Learn More -

Business Complete

You will be notified when a new business is added. This applies to the endpoint Business/RequestByUrl. The Webhook payload will have the payer's complete details. Learn More -

Order Complete

You will be notified when a new order is completed. Learn More -

PDF Complete

When you use the GetPDF endpoint, the URL to download the form PDF will be sent via webhook. Learn More -

Form 1099 Auto-Generation

You will be notified when the 1099s are auto-generated based on the transactions. Learn More -

Form W-9 Status Change

You will be notified when the recipient submits Form W-9. It will also contain the TIN matching status and the URL to download the completed form. Learn MoreIf recipients fill in either W-9 or W-8BEN, you can use the 'WhCertificate Status Change' Webhook instead.

-

Form W-8BEN Status Change

You will be notified via webhook when the recipient submits Form W-8BEN. Learn MoreIf recipients fill in either W-9 or W-8BEN, use the 'WhCertificate Status Change' Webhook instead.

-

WhCertificate Status Change

You will be notified via webhook when the recipients submit either W-9, W-8BEN, or W-8 BEN-E (based on their citizenship). Learn More -

TIN Matching Status Change

You will be notified when the status of TIN Matching changes. The payload will have TIN Matching order status, Timestamp on when the status change occurred, and the number of TIN Matching attempts remaining for the particular recipient TIN.If TIN Matching is opted as part of Form W-9 or WhCertificate endpoints, the TIN Matching status will be provided in the respective webhook itself. Learn More

-

Instant TIN Matching

If you've opted for Instant TIN Matching services to verify the Taxpayer Identification Numbers (TINs) of your recipients/vendors, configure this Webhook to receive notifications about the verification process. Learn More -

Form 8453-EMP Status Change

You will be notified when the taxpayer or tax-preparer has signed or declined to sign the 8453-EMP form. Learn More