Online Access for 1099/W-2 Form Copies

The timely distribution of 1099/W-2 form copies to the corresponding recipients is crucial to ensure tax compliance.

As an alternative to the traditional way of printing and mailing form copies to the recipients, you can opt for Online Access, wherein you can distribute the form copies digitally to the respective recipients.

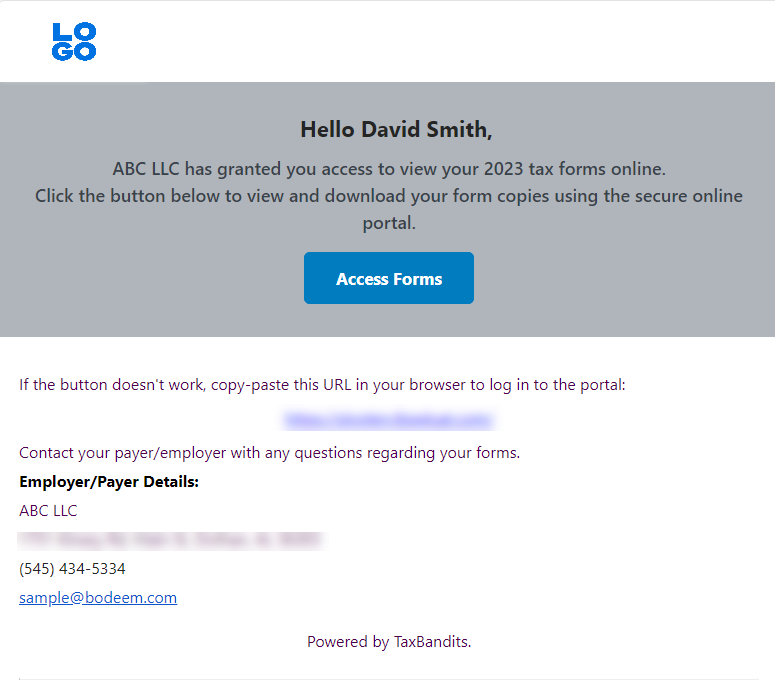

When you opt for Online Access, your recipients will get an email with a link to access a Secure Online Portal where they can provide consent, access and download their form copies.

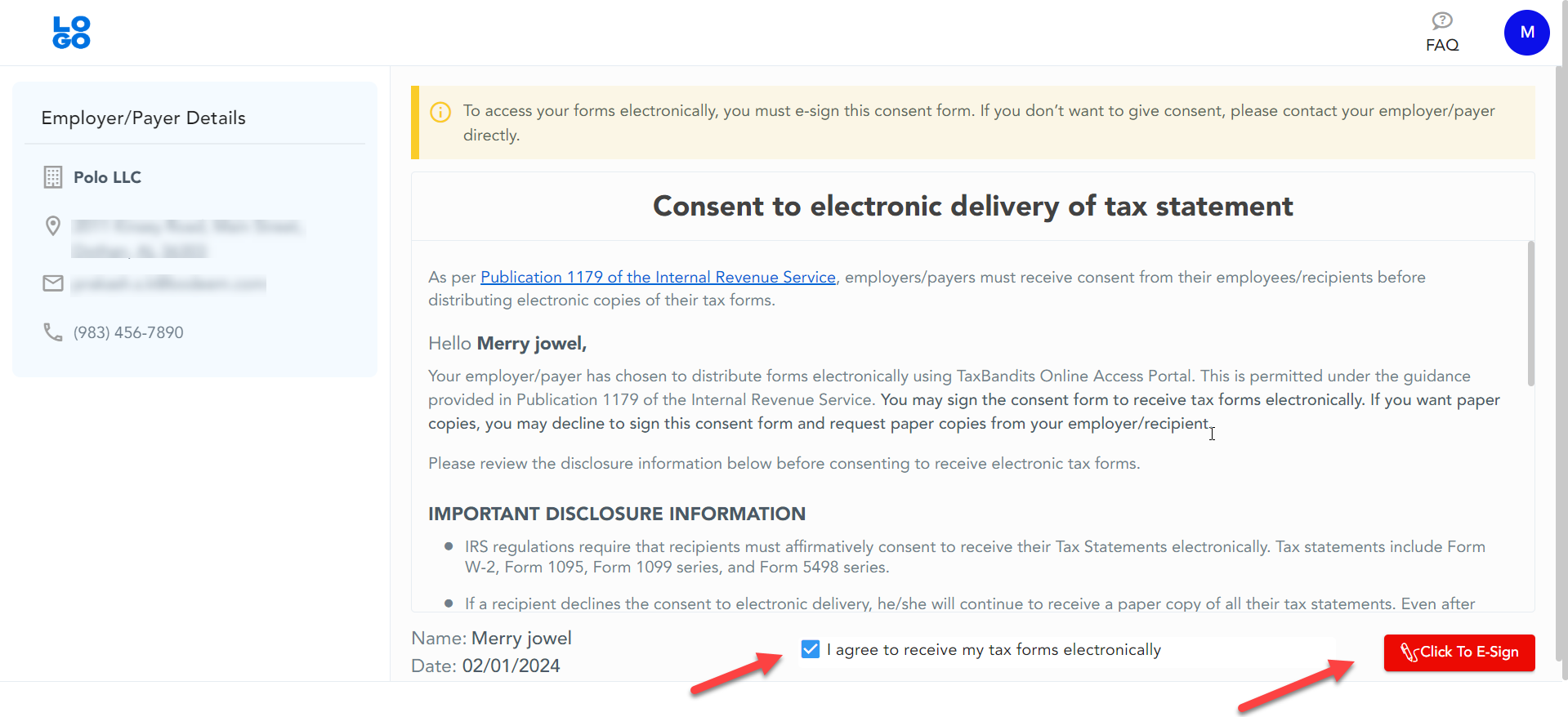

Note: As per the IRS, to distribute the recipient copies online, you must obtain consent from the corresponding recipients.

Customization of Online Access Portal

TaxBandits API allows you to customize the Email Sent and the Online Access portal with your business URL, logo, and theme to reflect your brand.

In order to do so, you must log in to TaxBandits UI: https://secure.taxbandits.com/ and follow the steps mentioned here.

How Online Access Process Works:

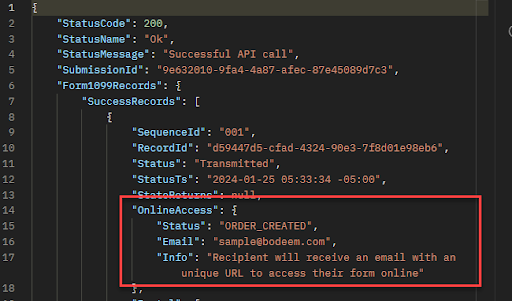

- Step 1 - While creating a 1099/W-2 return, set the IsOnlineAccess as ‘True’ and provide the recipient email address in the request body. Once the return is transmitted, an order will be created for Online Access.

- Step 2 - The recipient will receive an email with a link to access the Secure Online Access Portal.

- Step 3 - The recipients will need to e-sign to provide consent to receive the digital copy of the forms.

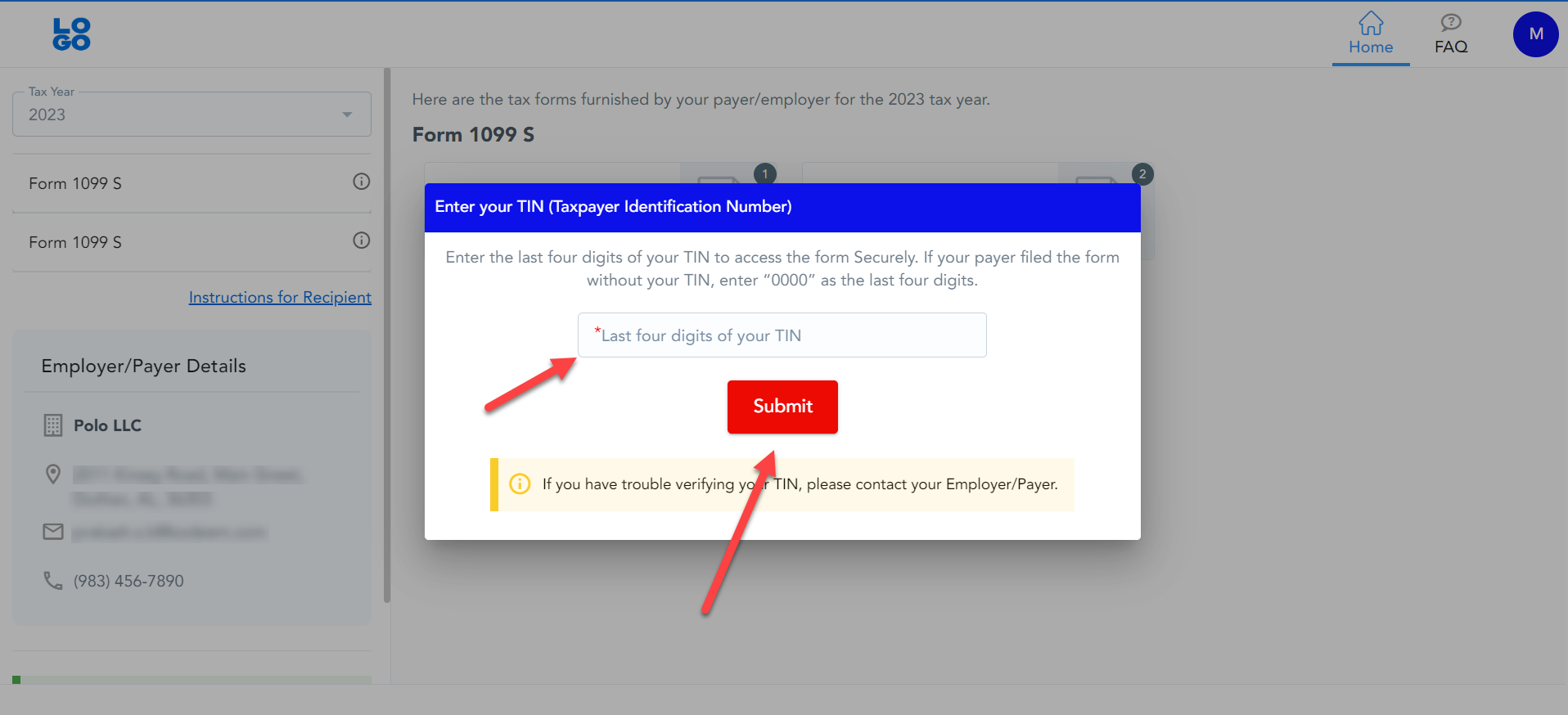

- Step 4 - The recipients will then need to provide the last four digits of their TIN to complete verification.

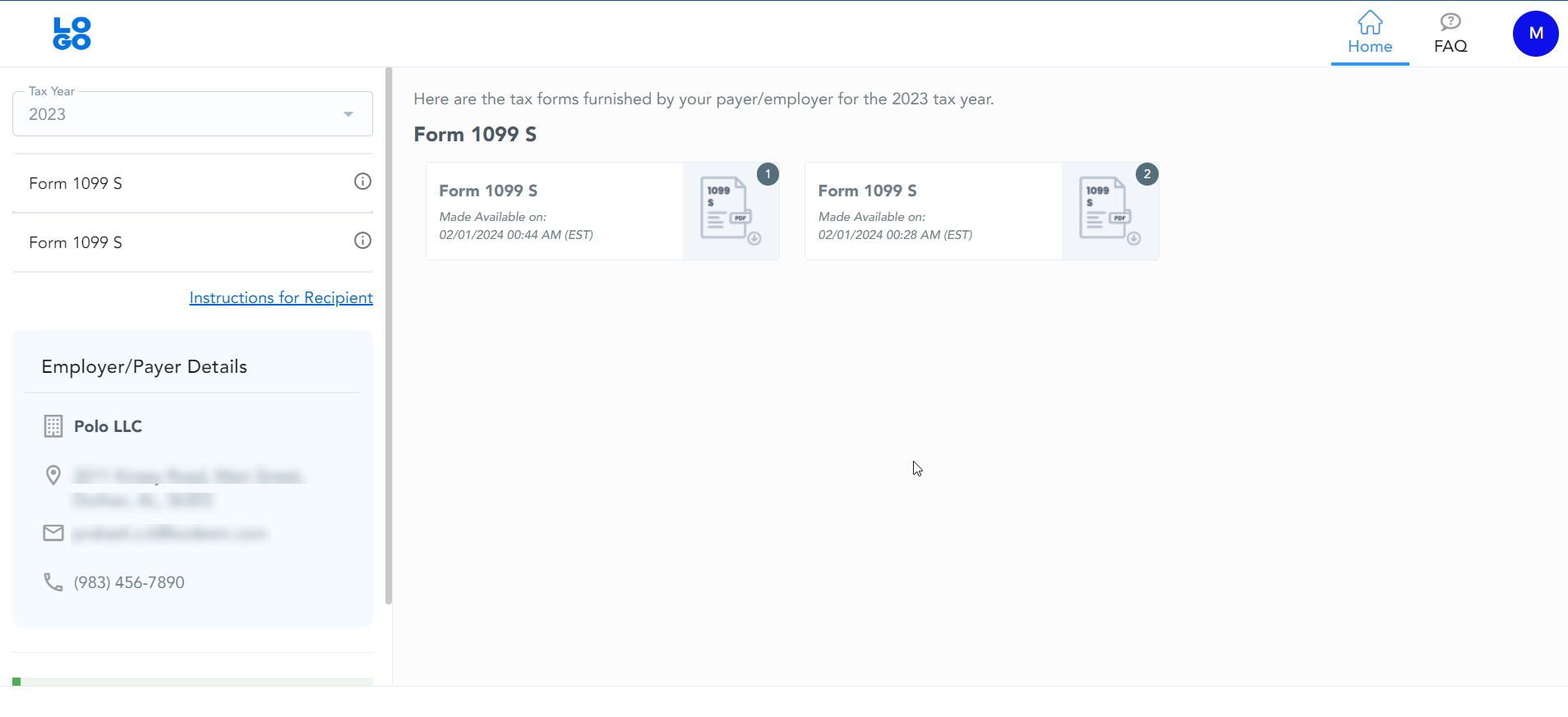

- Step 5 - Once verification is completed, the recipients will be able to access and download their form copies.