Use our comprehensive documentation and develop with confidence! View Docs

Understanding Beneficial Ownership Information Reporting Automation – BOI API Explained

- Effective January 1, 2024, the Corporate Transparency Act (CTA) mandates that certain U.S. and foreign entities report their Beneficial Ownership Information (BOI) to FinCEN, a bureau of the U.S. Department of the Treasury.

- This new reporting requirement is aimed at increasing financial transparency to prevent illicit activities such as money laundering.

- TaxBandits API fully supports the electronic filing of the BOI report, ensuring businesses can meet FinCEN compliance with maximum efficiency.

Maximize Your Revenue While Unlocking Efficiency with TaxBandits BOIR API

According to FinCEN, an estimated 32.6 million small businesses are required to submit BOI reports this year. TaxBandits API brings you an ideal opportunity to expand your offerings into BOI reporting for your clients.

- Integrating TaxBandits API with your software or portal facilitates streamlined BOI reporting for you and your clients.

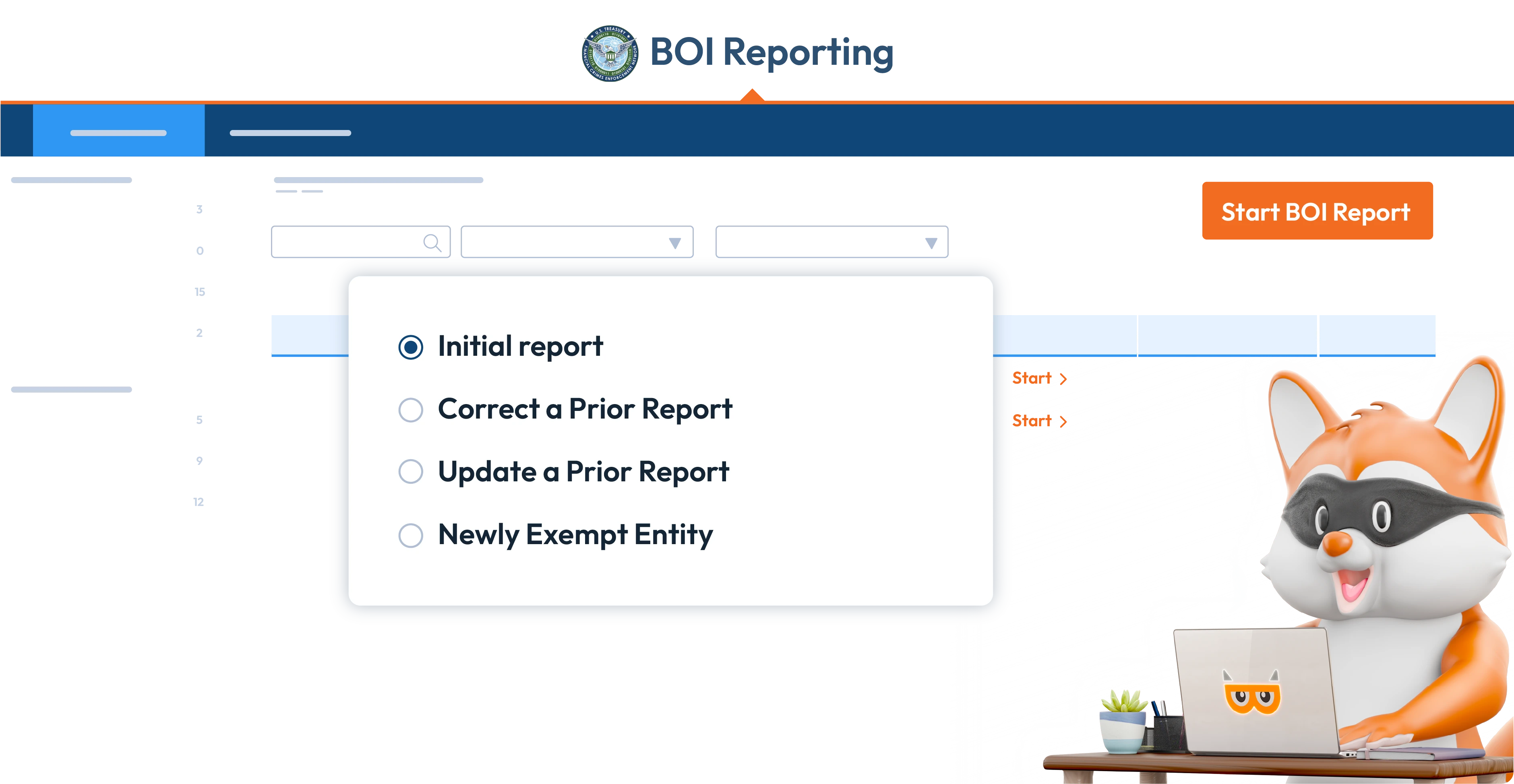

- Our API provides a simplified way to automate BOI reporting, ensuring FinCEN compliance while reducing the manual processes involved. We support all types of BOI reports – Initial, Update, Correction, and Newly Exempt Entity.

How to Integrate TaxBandits BOIR API?

Develop

Create a free sandbox account to get started with TaxBandits API.

Test

Test and simulate the BOIR process in a secure sandbox environment.

Deploy

Integrate our API and start your journey to seamless FinCEN BOI compliance.

How to Automate BOI Reporting with TaxBandits API?

Following are the API endpoints you can use to automate BOI reporting right from your software.

Create

To create a Beneficial Ownership Information (BOI) report, use the BOIR/Create endpoint and set the ReturnType as INITIAL, UPDATE, CORRECT, or EXEMPT based on the report type required.

Attach Documents

FinCEN requires identification documents for each Company Applicant and Beneficial Owner reported in the BOI report. Use the BOIR/AttachDocuments endpoint to upload these documents.

Transmit

Once completed, you can transmit the BOI Report to FinCEN using the BOIR/Transmit endpoint.

Status

To get the status of the BOI Report created in TaxBandits, use

BOIR/Status endpoint.

Webhooks

As an alternative to the Status endpoint, you can also configure Webhook for the event type ‘BOIR Report Status Change‘ to receive FinCEN status updates (Accepted/Rejected) for the BOI reports you submitted.

Transcript

Use the BOIR/GetTranscript endpoint to retrieve the transcript for the BOI reports accepted/rejected by the FinCEN.

Powerful Tools and Features Exclusively Designed for Developers!

TaxBandits provides a developer-friendly API with a suite of essential resources tailored specifically for developers to ensure seamless integration.

Clear Documentation

Our API includes comprehensive documentation with clear instructions on how to create, update, and e-file BOI reports using various endpoints.

SDK

TaxBandits provides SDK libraries in multiple programming languages such as Java, Node.js, .NET, C#, and Python to help you effectively utilize our API.

Sandbox Environment

The Sandbox environment enables the simulation of the end-to-end BOI reporting process to understand how it works.

Advanced Security

As a SOC-2 Certified company, TaxBandits employs numerous security protocols to protect sensitive information throughout

the process.

Frequently Asked Questions about BOI Reporting API

1. How will I be notified when FinCEN accepts/rejects my BOI report?

- If the FinCEN accepts/rejects your BOI reports transmitted through TaxBandits API, you'll be notified via Webhooks (if configured), or you can use the BOIR/Status endpoint.

2. I failed to include a beneficial owner in my initial BOI report. What should I do?

- If you have missed adding a beneficial owner who was already part of the reporting company at the time when you submitted the initial report, you must submit a correction

within 30 days. - To submit a correction using TaxBandits API, use the BOIR/Create endpoint and set the 'ReportType' to 'CORRECT'. For more information, click here

3. How do I file an updated report with FinCEN?

- Create a BOIR with 'ReportType' as 'UPDATE'. You must provide your Initial Report's SubmissionId under the object "PrevReportDetails". Make the necessary updates and

transmit the report. - For detailed information, click here.

4. How do I upload the identifying documents of beneficial owners/company applicants?

- Once a BOI report is created, you will be provided with a unique Id for each Company applicant (CompanyApplicantId) & Beneficial Owners (BeneficialOwnerId).

- Then, using the BOIR/AttachDocuments endpoint, you can upload the necessary identifying documents for the company applicants and beneficial owners using the respective Ids.

5. How do I get the transcript of my submitted BOIR?

- Once your report is accepted or rejected, you can get the transcript using the BOIR/GetTranscript endpoint.