Overview

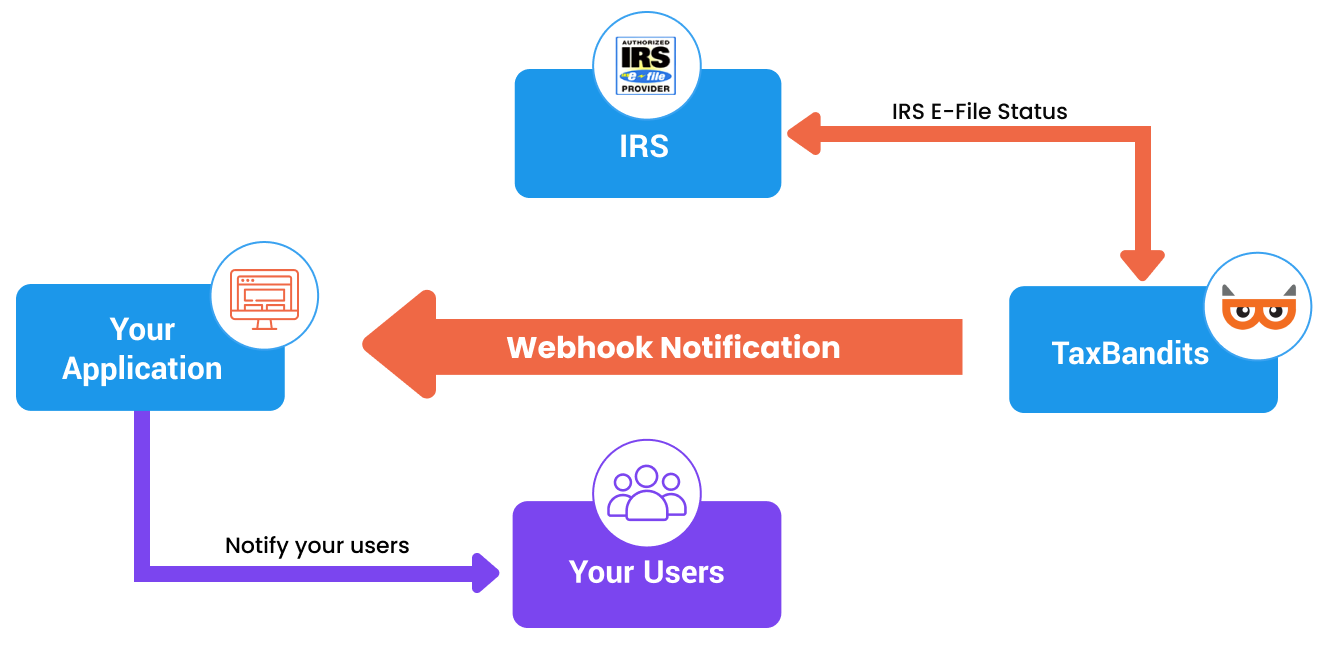

Tax filing is a long-running process, and it can be difficult to keep track of your filings. To simplify this process for you, the TaxBandits API uses Webhooks, allowing you to track your filing statuses efficiently.

Webhook Configuration

In order to use Webhooks in TaxBandits API, you must configure Webhooks in the Developer Console site. You can follow the steps below to configure Webhooks:

-

Log in to the Developer Control Panel. Navigate to Settings >> Webhook Notifications

-

Click the Add Webhook button and choose the Event Type you prefer. Select Event Type to know the list of events supported.

-

Enter the callback URL and click on the Submit button. You must ensure that the callback URL you enter is valid, as the API will authenticate this URL by posting a sample JSON. The URL will be activated only when we receive a 200 response. You must follow these best practices to have a valid callback URL for Webhook.

-

Then, provide a Notify email. TaxBandits will use this email to notify you regarding any failed attempts of Webhook posting.

Best Practices to Have a Valid Callback URL for Webhook

-

SSL Certificate - The URL you provide must have a valid SSL certificate, i.e., TaxBandits API accepts only HTTPS URLs.

-

IP Whitelisting - It’s important that you whitelist our IPs from which the Webhooks will be sent to avoid unauthorized access to the callback URLs.

-

Frequent Testing - Frequently, you can send a test notification from our Sandbox console to the callback URL and make sure it is active.

Note: To understand how the Webhook process works, you can make use of Webhook testing sites such as Webhook.site, PostBin, RequestBin, etc.

Webhook Event Types

You can set up Webhooks for the following events:

-

E-File Status Change

When the agency accepts or rejects your tax return, you will be notified via this Webhook. Learn More

-

PDF Complete

When you use the GetPDF endpoint, the URL to download the form PDF will be sent via this Webhook event type. Learn More

-

Postal Sent

When the recipient copies (W-2, 1099) are postal mailed, you will be notified via this Webhook. Learn More

-

Form W-9 Status Change

When the recipient submits Form W-9, you will be notified via this Webhook. The Webhook payload will have W-9 details. It will also contain the TIN matching status and the URL to download the completed form (if you opted for it).

If recipients fill in either W-9 or W-8BEN, you can use 'WhCertificate Status Change' Webhook instead. Learn More

-

Form W-8BEN Status Change

When the recipient submits Form W-8BEN, you will be notified via this Webhook. The Webhook payload will have W-8BEN details.

If recipients fill in either W-9 or W-8BEN, use 'WhCertificate Status Change' Webhook instead. Learn More

-

WhCertificate Status Change

When the recipients submit either W-9 or W-8BEN or W-8 BEN-E (based on their citizenship), you will be notified via this Webhook. The Webhook payload will have W-8BEN details. It may also contain the TIN matching status and the URL to download the completed form (if you opted for it). Learn More

-

TIN Matching Status Change

When the status of TIN Matching changes, you will be notified via this Webhook. The payload will have TIN Matching order status, Timestamp on when the status change occurred, and the number of TIN Matching attempts remaining for the particular recipient TIN.

If TIN Matching is opted as part of Form W-9 or WhCertificate endpoints, the TIN Matching status will be provided in the respective Webhook itself (WhCertificate Status Change or Form W-9 Status Change). Learn More

-

Business Complete

When a new business is added, you will be notified via this Webhook. This applies to the endpoint Business/RequestByUrl. The Webhook payload will have the complete details of the payer. Learn More

-

Form 1099 Auto-Generation

When the 1099s are auto-generated based on the transactions, you will be notified via this Webhook. Learn More

-

List of all possible IPs for sandbox and production mode

Sandbox 129.213.192.60 Live 129.213.79.42 These are the ips we set in header for the webhooks.