Exploring SDK Of Taxbandits Api

TaxBandits offers open Software Development Kit (SDK) libraries that are available in several programming languages , such as Java, Node JS, C# and Python.

Prerequisites

Here are the important URLs in the Sandbox environment:

● Developer Console: sandbox.taxbandits.com

● API: testapi.taxbandits.com/version

Note :There are different API versions available such as 1.7.3, 1.7.1, 1.7.0, and 1.6.1. You can choose the version you prefer.

● Authentication API: testoauth.expressauth.net/v2/tbsauth

To get started with TaxBandits API, users have to sign up in our Sandbox environment. After logging in, navigate to Settings >> API Credentials to receive the following authentication keys:

-

Client ID

-

Client secret

-

User Token

Note: Do not share the keys with any individual or business.

Sample Code snippets from .NET SDK using JWT

Here is a sample code snippet to hit Form 941 Create endpoint along with the OAuth authentication logics:

To start with, set the appropriate keys in the App.config file as shown below:

*<!--URLs-->*

<add key="OAuthApiUrl" value="https://testoauth.expressauth.net/v2/" />

<add key="PublicAPIUrlWithJWT" value="https://testapi.taxbandits.com/v1.6.0/" />

<add key="OAuthApiMethodRoute" value="tbsauth" />

*<!--JWT Credentials from Dev Console (Settings ==> API Credentials)-->*

<add key="ClientId" value="--Your ClientId here--" />

<add key="ClientSecret" value="--Your ClientSecret here--" />

<add key="UserToken" value="--Your UserToken here--" />

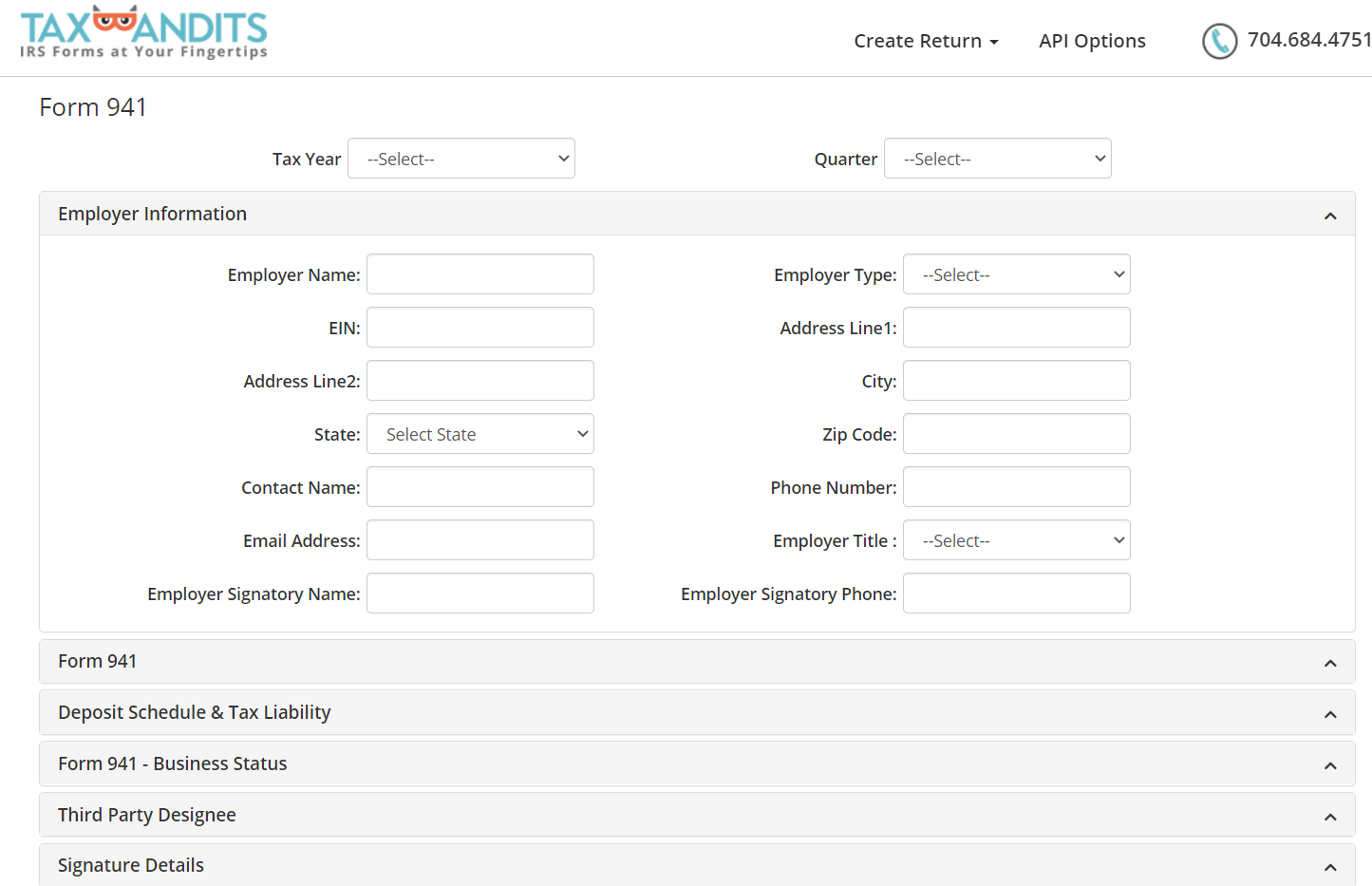

Retrieve classes to construct a 941 CREATE request from TaxBandits SDK. Running the .NET SDK can help you provide test values in a UI & submit them.

Upon submitting the above form, the following code snippet gets executed:

//Get URLs from App.Config

string oAuthApiUrl = Utility.GetAppSettings("OAuthApiUrl");

string apiUrl = Utility.GetAppSettings("PublicAPIUrlWithJWT");

//Call OAuth API

using (var oAuthClient = new HttpClient())

{

string oAuthRequestUri = Utility.GetAppSettings("OAuthApiMethodRoute");

oAuthClient.BaseAddress = new Uri(oAuthApiUrl);

//Generate JWS and get access token (JWT)

OAuthGenerator.GenerateJWSAndGetAccessToken(oAuthClient);

//Read OAuth API response

var response = oAuthClient.GetAsync(oAuthRequestUri).Result;

if (response != null && response.IsSuccessStatusCode)

{

var oauthApiResponse = response.Content.ReadAsAsync<AccessTokenResponse>().Result;

if (oauthApiResponse != null && oauthApiResponse.StatusCode == 200)

{

//Get Access token from OAuth API response

string accessToken = oauthApiResponse.AccessToken;

//Access token is valid for one hour. After that call OAuth API again & get new Access token.

if (!string.IsNullOrWhiteSpace(accessToken))

{

//Call TaxBandits API using the Access token

//Access token is valid for one hour. After that call OAuth API again & get new Access token.

using (var apiClient = new HttpClient())

{

//API URL to Create Form 941 Return

string requestUri = "Form941/Create";

apiClient.BaseAddress = new Uri(apiUrl);

//Construct HTTP headers

//If the Access token got expired, call OAuth API again & get a new Access token.

OAuthGenerator.ConstructHeadersWithAccessToken(apiClient, accessToken);

//Get Response

var apiResponse = apiClient.PostAsJsonAsync(requestUri, form941ReturnList).Result;

if (apiResponse != null && response.IsSuccessStatusCode)

{

//Read Response

var createResponse = apiResponse.Content.ReadAsAsync<Form941CreateReturnResponse>().Result;

if (createResponse != null)

{

responseJson = JsonConvert.SerializeObject(createResponse, Formatting.Indented);

//Deserializing JSON (Success Response) to Form941CreateReturnResponse object

form941Response = new JavaScriptSerializer().Deserialize<Form941CreateReturnResponse>(responseJson);

if (form941Response.SubmissionId != null && form941Response.SubmissionId != Guid.Empty)

{

//Adding Form941CreateReturnResponse Response to Session

APISession.AddForm941APIResponse(form941Response);

}

}

}

else

{

var createResponse = apiResponse.Content.ReadAsAsync<Object>().Result;

responseJson = JsonConvert.SerializeObject(createResponse, Formatting.Indented);

//Deserializing JSON (Error Response) to Form941CreateReturnResponse object

form941Response = new JavaScriptSerializer().Deserialize<Form941CreateReturnResponse>(responseJson);

}

}

}

}

}

}

Here is a sample of create request JSON of Form 941. For a more detailed explanation of the JSON, fields refer to the documentation.

{

"Form941Records": [

{

"SequenceId": "001",

"ReturnHeader": {

"ReturnType": "FORM941",

"TaxYr": "2023",

"Qtr": "Q1",

"Business": {

"BusinessId": null,

"BusinessNm": "Snowdaze LLC",

"TradeNm": " Meefto",

"IsEIN": true,

"EINorSSN": "865626415",

"Email": "sample@bodeem.com",

"ContactNm": "Alice John",

"Phone": "9894216412",

"PhoneExtn": null,

"Fax": "3236415281",

"BusinessType": "ESTE",

"SigningAuthority": {

"Name": "Tina Charles",

"Phone": "7498798798",

"BusinessMemberType": "ADMINISTRATOR"

},

"KindOfEmployer": null,

"KindOfPayer": null,

"IsBusinessTerminated": false,

"IsForeign": true,

"USAddress": {

"Address1": "1751 Kinsey Rd",

"Address2": "Main St",

"City": "Dothan",

"State": "AL",

"ZipCd": "36303"

},

"ForeignAddress": {

"Address1": "1751 Kinsey Rd",

"Address2": "Main St",

"City": "Dothan",

"ProvinceOrStateNm": "NY",

"Country": "UK",

"PostalCd": "78867789"

}

},

"IsThirdPartyDesignee": false,

"ThirdPartyDesignee": {

"Name": null,

"Phone": null,

"PIN": null

},

"SignatureDetails": {

"SignatureType": "ONLINE_SIGN_PIN",

"OnlineSignaturePIN": {

"PIN": "1262441864"

},

"ReportingAgentPIN": {

"PIN":null

},

"taxPayerPIN": {

"PIN": null

},

"Form8453EMP": null

},

"BusinessStatusDetails": {

"IsBusinessClosed": false,

"BusinessClosedDetails": {

"Name": null,

"FinalDateWagesPaid": null,

"IsForeign": false,

"USAddress": {

"Address1": "1751 Kinsey Rd",

"Address2": "Main St",

"City": "Dothan",

"State": "AL",

"ZipCd": "36303"

},

"ForeignAddress": {

"Address1": "1751 Kinsey Rd",

"Address2": "Main St",

"City": "Dothan",

"ProvinceOrStateNm": "NY",

"Country": "UK",

"PostalCd": "78867789"

}

},

"IsBusinessTransferred": false,

"BusinessTransferredDetails": {

"Name": null,

"BusinessChangeType": null,

"DateOfChange": null,

"NewBusinessType": null,

"NewBusinessName": null,

"IsForeign": true,

"USAddress": {

"Address1": null,

"Address2": null,

"City": null,

"State": null,

"ZipCd": null

},

"ForeignAddress": {

"Address1": "1751 Kinsey Rd",

"Address2": "Main St",

"City": "Dothan",

"ProvinceOrStateNm": "NY",

"Country": "UK",

"PostalCd": "78867789"

}

},

"IsSeasonalEmployer": false

}

},

"ReturnData": {

"Form941": {

"EmployeeCnt": 200,

"WagesAmt": 1264000.32,

"FedIncomeTaxWHAmt": 248000.32,

"WagesNotSubjToSSMedcrTaxInd": false,

"SocialSecurityTaxCashWagesAmt_Col1":14502.32,

"QualSickLeaveWagesAmt_Col1": 14280.64,

"QualFamilyLeaveWagesAmt_Col1": 11520.32,

"TaxableSocSecTipsAmt_Col1": 1420.36,

"TaxableMedicareWagesTipsAmt_Col1": 11512.64,

"TxblWageTipsSubjAddnlMedcrAmt_Col1": 7832.16,

"SocialSecurityTaxAmt_Col2": 1798.29,

"TaxOnQualSickLeaveWagesAmt_Col2": 885.40,

"TaxOnQualFamilyLeaveWagesAmt_Col2": 714.26,

"TaxOnSocialSecurityTipsAmt_Col2": 176.12,

"TaxOnMedicareWagesTipsAmt_Col2": 333.87,

"TaxOnWageTipsSubjAddnlMedcrAmt_Col2": 70.49,

"TotSSMdcrTaxAmt":3978.43,

"TaxOnUnreportedTips3121qAmt": 11204.62,

"TotalTaxBeforeAdjustmentAmt": 263183.37,

"CurrentQtrFractionsCentsAmt": 5200.36,

"CurrentQuarterSickPaymentAmt": 16412.28,

"CurrQtrTipGrpTermLifeInsAdjAmt": 5420.32,

"TotalTaxAfterAdjustmentAmt":290216.33,

"PayrollTaxCreditAmt": 1154.15,

"IsPayrollTaxCredit": true,

"Form8974": {

"Form8974IncomeTaxDetails": [

{

"IncomeTaxPeriodEndDate": "07-07-2023",

"IncomeTaxReturnFiledForm": "FORM1065",

"IncomeTaxReturnFiledDate": "07-07-2023",

"Form6765EIN": "006548956",

"Form6765Line44Amt": 5000,

"PreviousPeriodRemainingCreditAmt": 100,

"RemainingCredit": 4900

}

],

"Line7": 4900,

"Line8": 1798.29,

"Line9": 176.12,

"Line10": 1974.41,

"Line11": 987.21,

"PayerIndicatorType": "SECTION3121QIND",

"Line12": 987.21,

"Line13": 3912.79,

"Line14": 333.87,

"Line15": 166.94,

"Line16": 166.94,

"Line17": 1154.15

},

"NonRfdCrQualSickAndFamilyWagesB4_Apr1_2021": 0,

"NonRfdCrQualSickAndFamilyWagesAfter_Mar31_2021AndB4_Oct1_2021": 15248.63,

"TotlNonRfdCrAmt":16402.78,

"TotTaxAfterAdjustmentAndNonRfdCr": 273813.55,

"TotTaxDepositAmt":13248.12,

"RfdCrQualSickAndFamilyWagesB4_Apr1_2021": 12126.32,

"RfdCrQualSickAndFamilyWagesAfter_Mar31_2021AndB4_Oct1_2021": 1218.44,

"TotDepositAndRfdCrAmt": 26592.88,

"BalanceDueAmt": 247220.67,

"OverpaidAmt": 0,

"OverPaymentRecoveryType": null,

"QualHealthPlanExpToSickLeaveWagesB4_Apr1_2021": 1200.66,

"QualHealthPlanExpToFamilyLeaveWagesB4_Apr1_2021": 1520.64,

"QualSickLeaveWagesAfter_Mar31_2021AndB4_Oct1_2021": 14282.34,

"QualHealthPlanExpToSickLeaveWagesAfter_Mar31_2021AndB4_Oct1_2021": 12118.66,

"CBAToSickLeaveWagesAfter_Mar31_2021AndB4_Oct1_2021": 5420.66,

"QualFamilyLeaveWagesAfter_Mar31_2021AndB4_Oct1_2021": 55281.44,

"QualHealthPlanExpToFamilyLeaveWagesAfter_Mar31_2021AndB4_Oct1_2021": 291864.32,

"CBAToFamilyLeaveWagesAfter_Mar31_2021AndB4_Oct1_2021": 1840.32

},

"IRSPaymentType": "EFTPS",

"IRSPayment": {

"BankRoutingNum": null,

"AccountType": null,

"BankAccountNum": null,

"Phone": null

},

"DepositScheduleType": {

"DepositorType": "MONTHLY",

"MonthlyDepositor": {

"TaxLiabilityMonth1":50000.00,

"TaxLiabilityMonth2": 173813.55,

"TaxLiabilityMonth3": 50000.00

},

"SemiWeeklyDepositor": null,

"TotalQuarterTaxLiabilityAmt": 273813.55

}

}

}

]

}

For more sample JSONs and explanations of their fields for all the supported forms, check out the documentation

For any further assistance, feel free to contact our 24*7 South Carolina-based support team at 704.684.4751 or send us an email to developer@taxbandits.com.