TaxBandits API : Trusted by Developers

1M

Businesses

10+ years

Industry Experience

40+

IRS/SSA Forms

24x7

Dedicated Dev Support

10+

CPEOs

Automate Your Tax Filings Right From Your Software!

Services Offered by TaxBandits API

Federal Filing

E-file your federal tax returns

on time and comply with

IRS/SSA filing requirements.

State Filing

E-File 1099, W2, ACA

with the state. We also

supports state-only filing.

Recipient Copy Distribution

Furnish the form copies to

your recipients either via Postal

Mail or Secure Online Portal.

Form W9 Manager

Collect and manage W-9

forms

from your vendors

via email, text,

secure URL,

or drop-in UI.

TIN Matching

Verify that the TINs your vendors provided on W-9 Forms match the IRS database.

Corrections

If any changes are needed on the 1099/W-2 forms you filed, you can file a correction after the IRS/SSA accepts them.

Easily record vendor transactions and auto-generate 1099s at the year-end

With the TaxBandits 1099 Transaction API, you can record all payments made to vendors, gig workers, and affiliates throughout the year. Easily upload transactions in bulk and sync the data with your internal systems. At the end of the year, you can easily generate 1099 forms based on the transactions recorded.

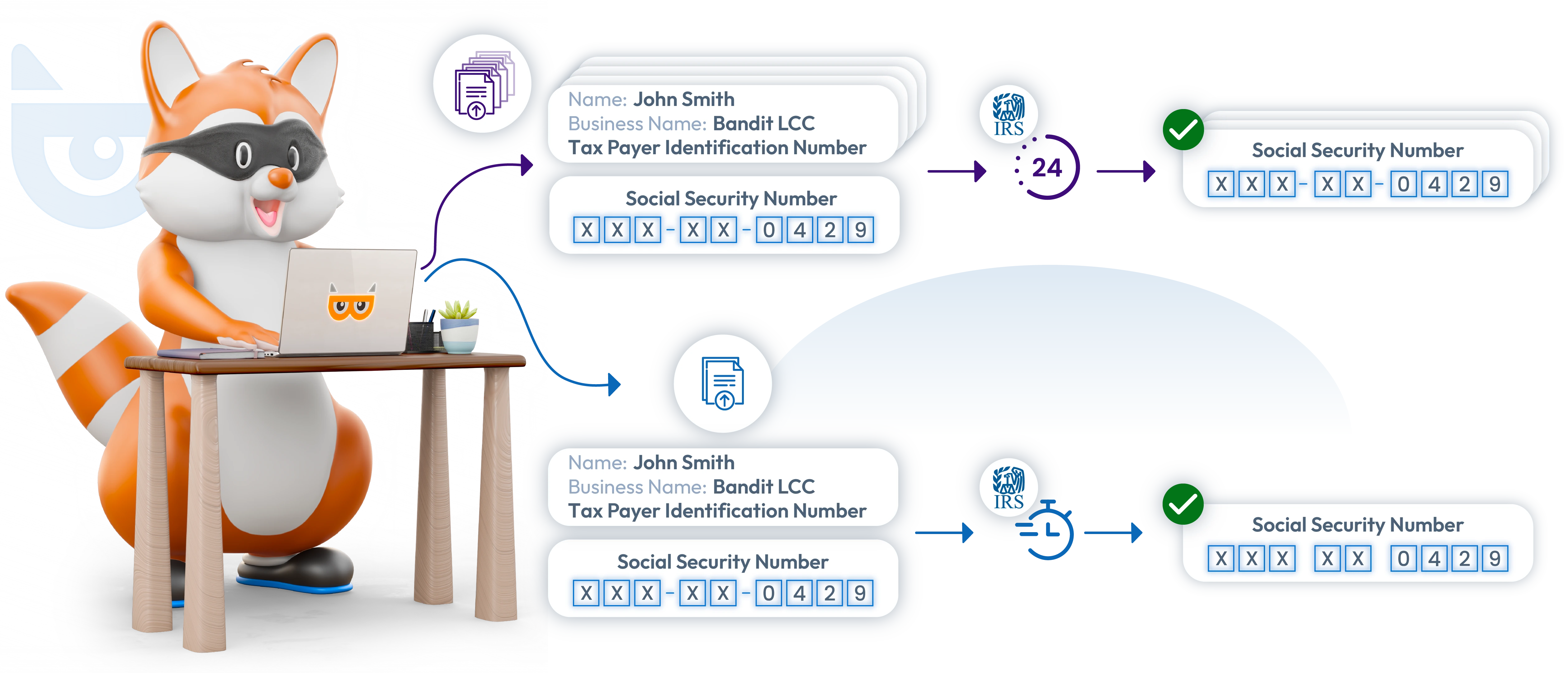

Ensure Accuracy with Our TIN

Matching API!

TaxBandits API offers two distinct services tailored to your business needs, allowing you to choose the one that best fits your use case.

- Bulk TIN Matching - Validate TINs in batches, process multiple records in a single request, and receive results within 24-48 hours.

- Real-Time TIN Matching - Validate TINs instantly and retrieve real-time status updates while onboarding vendors or recipients.

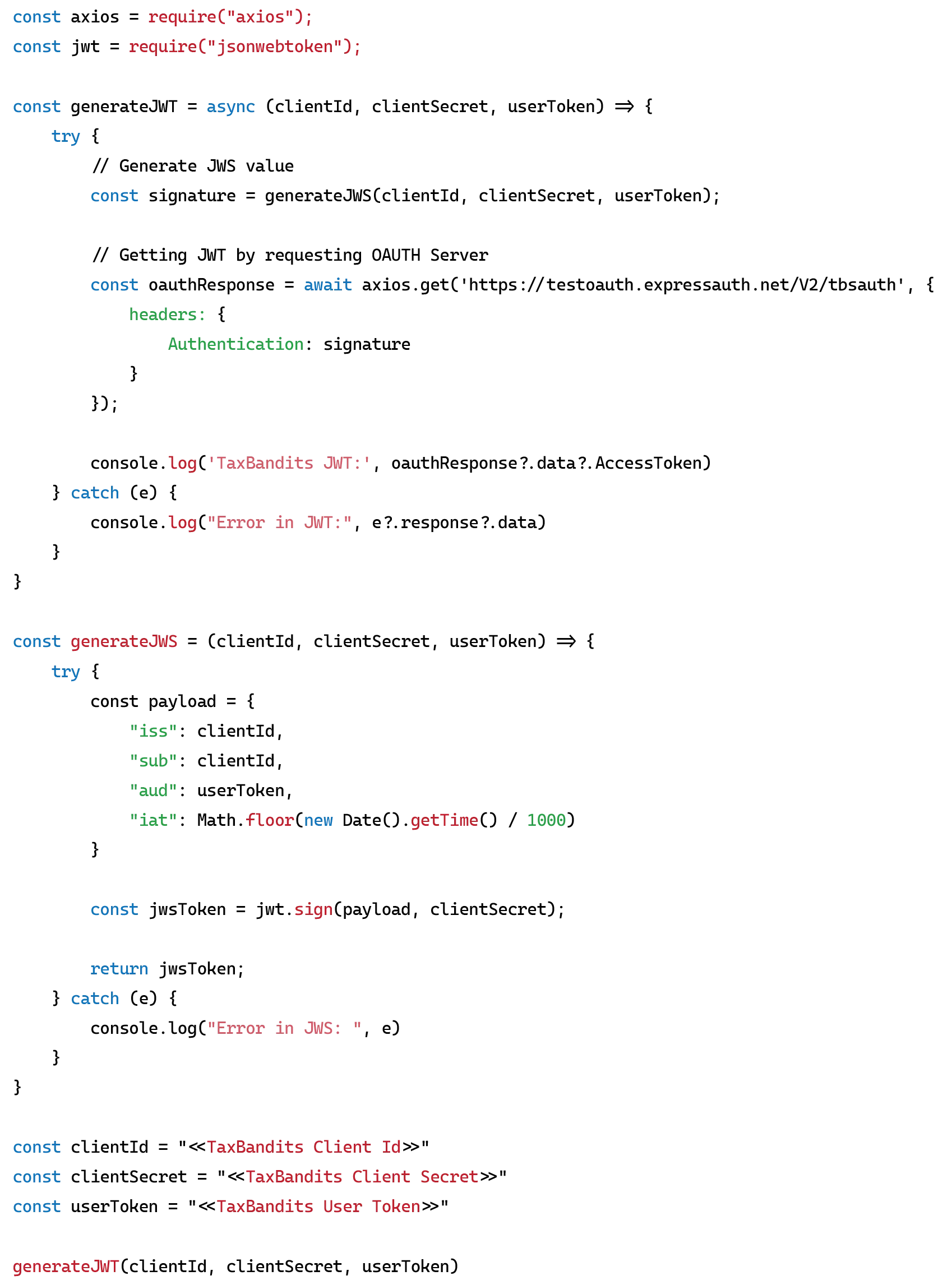

Develop with Confidence!

- A free developer account

- A secure sandbox environment for testing

- Postman collection

- Open SDK libraries

- Comprehensive documentation with code samples

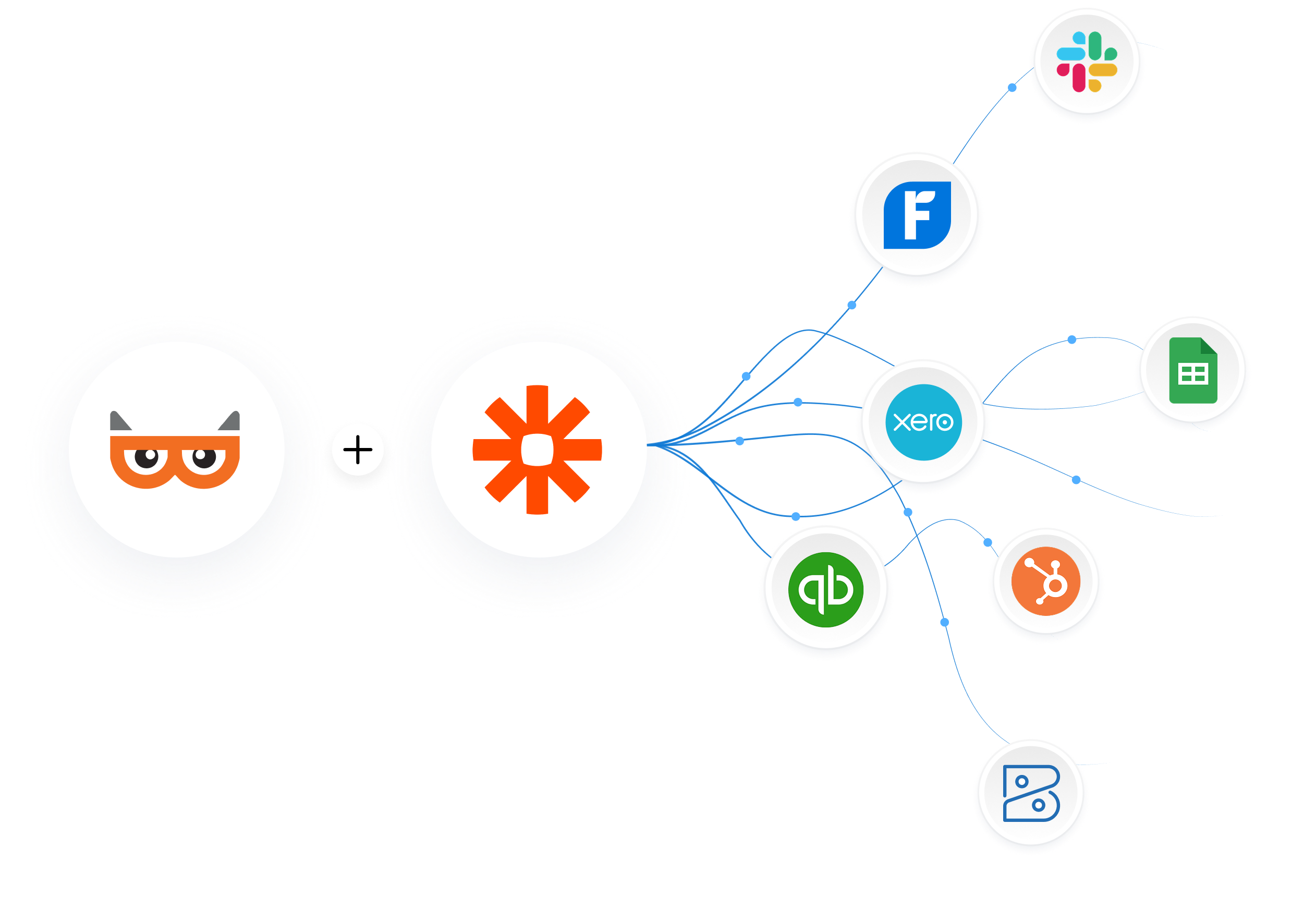

Scale Your Tax Workflows Beyond the API

While our API gives you full control over tax workflows, some teams need faster, lighter ways to connect TaxBandits to the application they already rely on. These features let you automate more of your filing operations without expanding your development footprint.

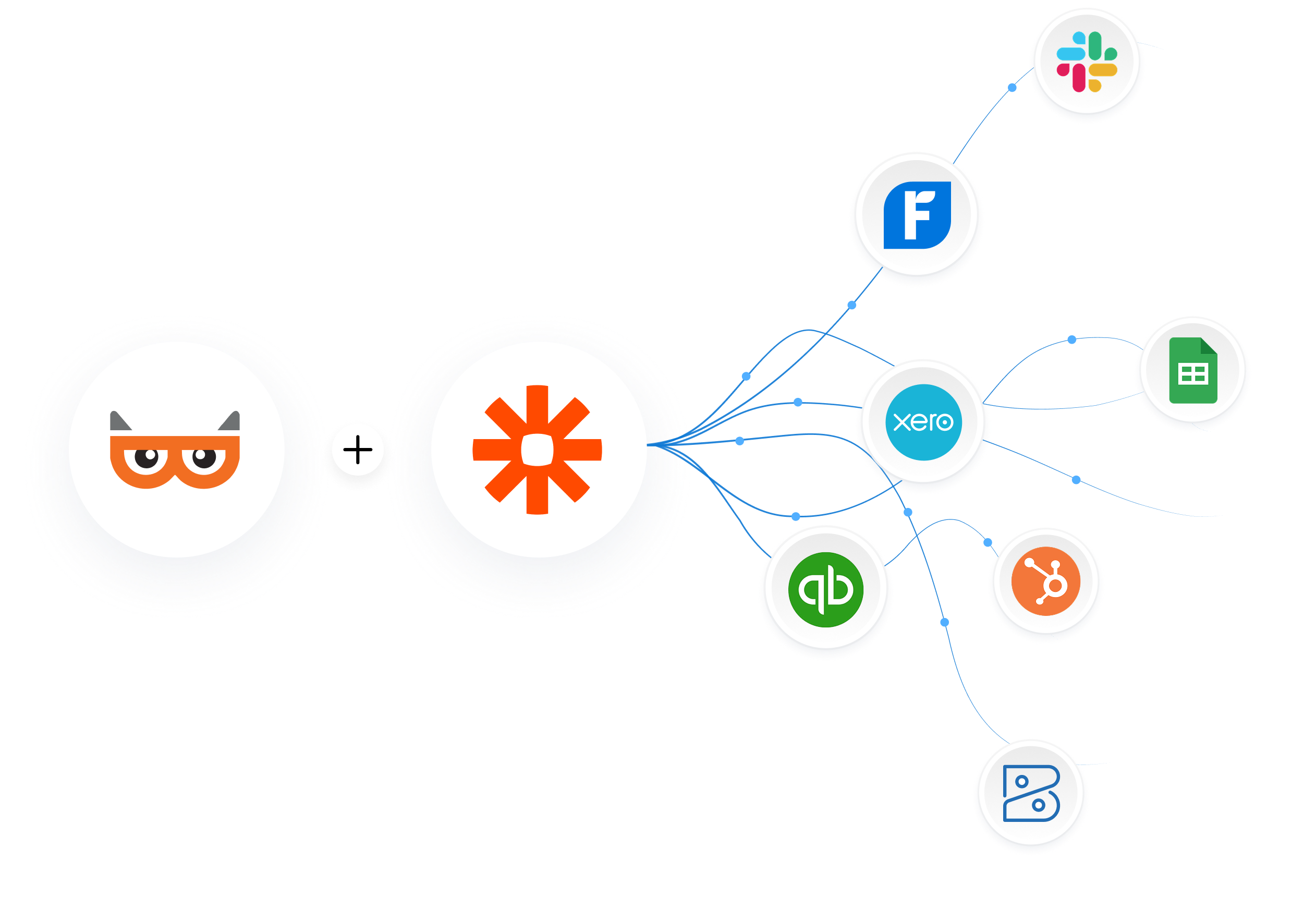

No-code automation powered

by Zapier

Connect TaxBandits instantly with apps like QuickBooks, HubSpot, Google Sheets, Slack, and more to automate everything—from W-9 collection and reminders to data syncing, filing triggers, and real-time status updates.

The best part? You don’t have to write a single line of code. This setup is flexible, customizable, and scales effortlessly with your business needs.

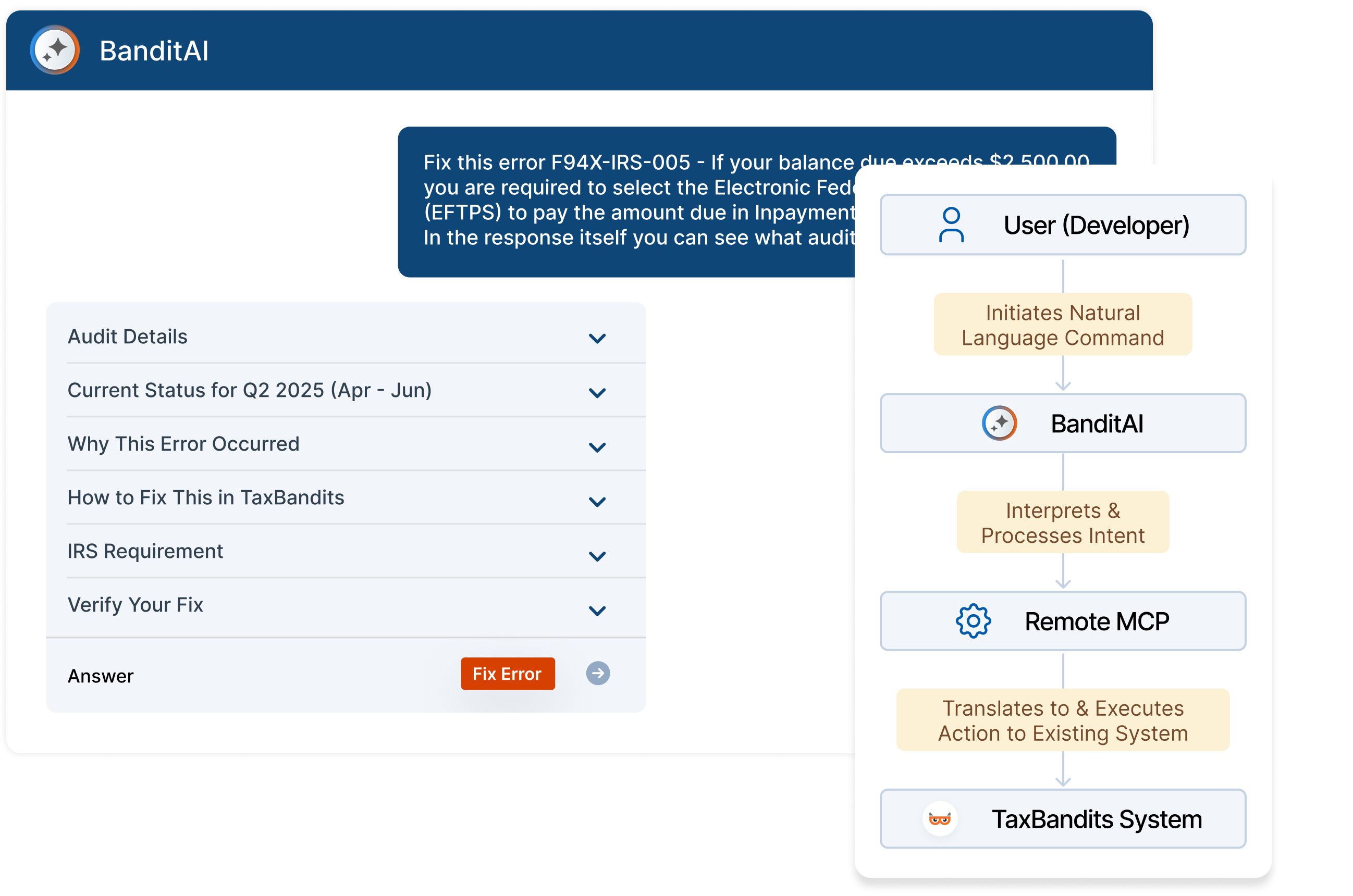

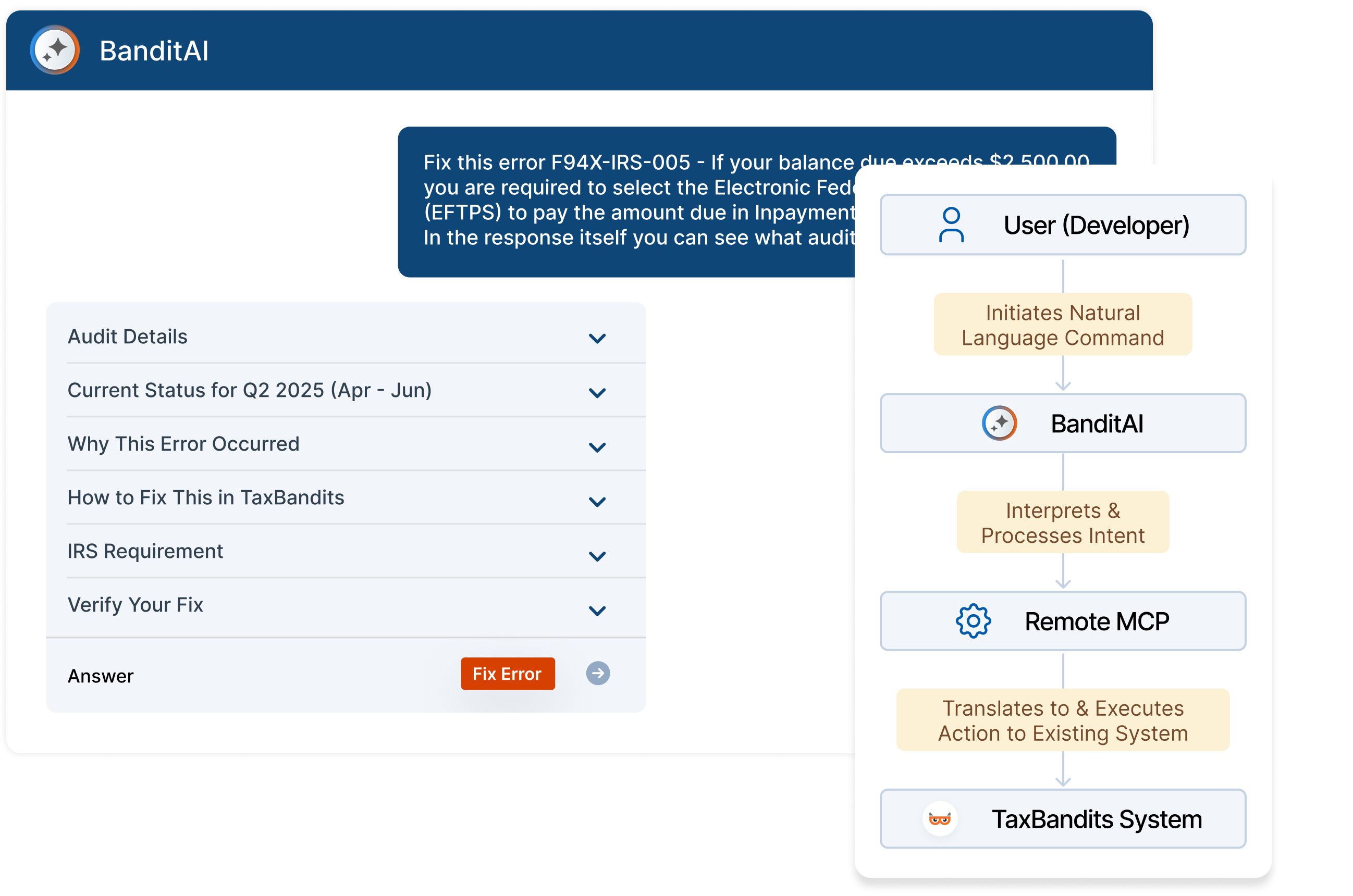

AI-driven workflow with

Remote MCP

Remote MCP gives you the ability to interact with TaxBandits using natural language — without writing new endpoints or building custom automation engines.

It’s the fastest way to layer intelligence and automation on top of your existing processes, enabling smarter workflows without adding infrastructure or development complexity.

Public API for Individuals

Use our API endpoints to enable the users to complete the filings within your software.

E-filing charges will be deducted from the prepaid credits in your account.

Error handling and status notifications will be handled at your end.

Public API for Platforms

Your clients' data will be transferred to TaxBandits, where they can complete their filings.

It involves a negotiable revenue-sharing model based on your business requirements.

TaxBandits will take care of the error handling and status updates.

Enhance your Clients’ Filing Experience with Our Public API for Platforms

TaxBandits offers a Public API exclusively for platforms. It is a hybrid model where users can transfer their data to TaxBandits UI from the client’s software and complete their filings.

- Each of the client’s users will get an individual account in TaxBandits.

- Once the data is transferred, access will be granted to the TaxBandits account to begin

e-filing returns.

TaxBandits E-filing API: A Valuable Addition to Your Software

TaxBandits API can be integrated with different software types to automate various aspects of tax preparation and filing. Here are some of the popular software types.

- Automate W-9 collection while onboarding gig workers and freelancers and validate their data through TIN Matching.

- Record payouts and let TaxBandits automate the filing and distribution of 1099-NEC, 1099 MISC, 1099-K, and other

1099 forms.

Ensure tax compliance right from your Payroll / CRM software by integrating TaxBandits API. You can use our API to automate W-9, and e-file your W-2, 941, 940, 941 Sch R, 940 Sch R, 1095, and 1099 forms.

Easily take care of all the tax filings for affiliate partners and merchants within your software. You can record transactions and automate W-9, TIN Matching, 1099-NEC, 1099-MISC, 1099-K, and other 1099 forms efficiently.

- Enable a streamlined automation of payroll and ACA filings right from your software.

- Our API integration lets you automate W-2, 940, 941, and ACA 1095 forms with complete ease and perfection.

Forms Supported by TaxBandits API

With TaxBandits API integration, you can simplify the preparation and e-filing of various tax returns. Our API supports

federal filing, state filing, and recipient copy distribution for major tax forms.

1099 Forms

- Form 1099-NEC

- Form 1099-MISC

- Form 1099-K

- Other 1099 Forms

Payroll Forms

- Form W-2

- Form 941

- Form 940

- Form 941 /

940 Schedule R

Others

- Form W-9

- TIN Matching

- Form 1095-C

- 1098-T

A Developer-Friendly API for Automating W-9 Collection, Tax

E-filing, and TIN Matching!

Sandbox Environment

The Sandbox environment allows the simulation of end-to-end

e-filing procedures and TIN validation for testing purposes.

SDK

TaxBandits offers SDK libraries in various programming languages, such as Java, Node JS, .Net, and Python, that helps you to use

our API.

Clear Documentation

Our API comes with comprehensive documentation with clear instructions that illustrate how endpoints are used to create, update, validate, and

e-file tax forms.

Advanced Security

TaxBandits is a SOC-2 Certified company that utilizes a number of security protocols to safeguard sensitive information throughout the process.