Take the Rush Out of IRS Deadlines with

Automated Extensions

- IRS deadlines can come up quickly, and extensions are often the best way to stay compliant.

- The TaxBandits API lets you automate IRS extension filings in minutes, right from your own systems, whether you're filing for your own business or clients. Use our endpoints to create, validate, submit, and track extension requests in real time.

- No PDFs, no portals, no bottlenecks. Just clean integration and reliable compliance, built for developers.

How It Works: Automating IRS Tax Extension Filings

TaxBandits API helps you automate every step of the extension process—accurately,

securely, and

at scale.

Create Extension Form

Initiate an extension filing request by passing the Create endpoint with required return type, filer details, and any other required info.

Transmit to IRS

Use the Transmit endpoint when you’re ready. TaxBandits will handle the submission—whether e-file, paper-file, or fax—based on IRS requirements.

Track Status

Get IRS acknowledgments for your extensions in real time, track extension status via Webhooks or by using the Status endpoint.

Extension Forms Supported by TaxBandits API

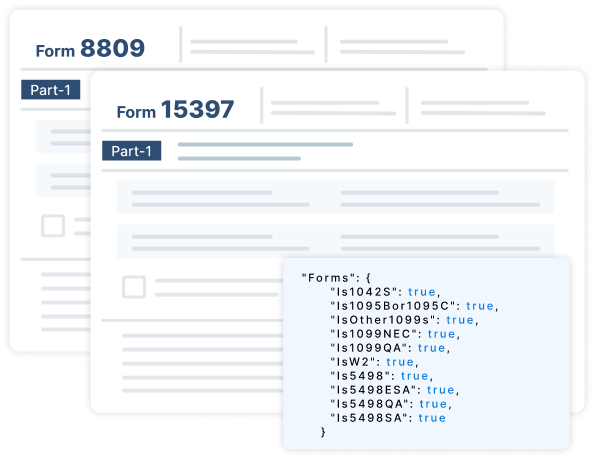

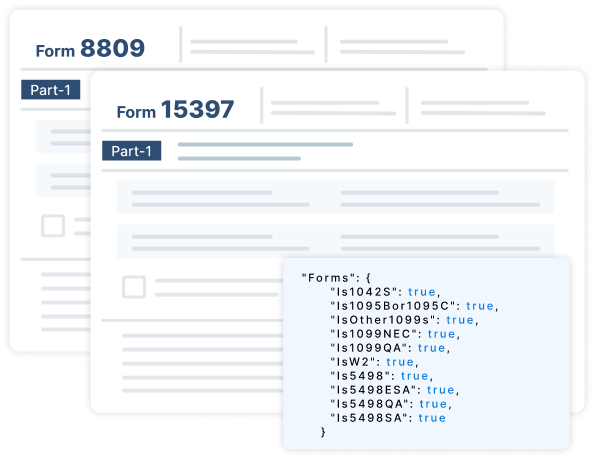

Form 8809

Information Return Filing Extension

Form 7004

Business Tax Extension

Form 4868

Personal Tax Extension

Form 15397

Information Return Recipient Copy Extension

Form 8868

Nonprofit Tax Extension

To view all forms supported by TaxBandits API, click here

Extension Forms Supported by TaxBandits API

Form 8809

Information Return Filing Extension

Form 7004

Business Tax Extension

Form 4868

Personal Tax Extension

Form 15397

Information Return Recipient Copy Extension

Form 8868

Nonprofit Tax Extension

State Extensions

Extension for State Personal and Business

Tax Returns

To view all forms supported by TaxBandits API, click here

Solving Deadline Chaos Across the Platforms

From individual taxpayers to large enterprises, TaxBandits Extension API helps you stay ahead of deadlines.

CPA & Advisory Firms

When your clients’ filing data arrive late, use our API to automate 4868 or 7004 extension requests in bulk, keeping everything on schedule.

Enterprises with Multi-Entity Filings

Corporations and holding groups managing dozens of 1120, 1065 can automate 7004 filings directly from internal systems, to secure more time.

Payroll & Benefits Platforms

Extend filing and furnishing deadlines for W-2, 1099, and ACA forms when employer data is delayed—using automated 8809 or 15397 requests.

Nonprofit & Grant Management Platforms

When Form 990 filings are delayed due to board approvals or audits, offer integrated 8868 extensions to help nonprofits stay compliant.

Solving Deadline Chaos Across the Platforms

From individual taxpayers to large enterprises, TaxBandits Extension API helps you stay ahead of deadlines.

CPA & Advisory Firms

When your clients’ filing data arrive late, use our API to automate 4868 or 7004 extension requests in bulk, keeping everything on schedule.

Enterprises with Multi-Entity Filings

Corporations and holding groups managing dozens of 1120, 1065 can automate 7004 filings directly from internal systems, to secure more time.

Payroll & Benefits Platforms

Extend filing and furnishing deadlines for W-2, 1099, and ACA forms when employer data is delayed—using automated 8809 or 15397 requests.

Nonprofit & Grant Management Platforms

When Form 990 filings are delayed due to board approvals or audits, offer integrated 8868 extensions to help nonprofits stay compliant.

Initiate the W-9 collection process by sending secure email requests directly to vendors or contractors. Each email includes a unique link for recipients to complete and e-sign the form. You can customize this email to reflect your branding. Learn more

Popular Use Case:

Accounting or CRM platforms can use this method to request W-9s from vendors, gig workers, or affiliates, right from within their systems.

Create unique, secure URLs for each vendor to complete their W-9/W-8 forms independently. These URLs can be embedded into your software or portal as an iframe or shared directly via official communication tools. Learn more

Popular Use Case:

Platforms with a large number of content creators can generate unique links for each creator to complete their W-9/W-8 forms directly from their platform.

Generate a common public URL, embed it in your website, where any of your vendors and contractors can access and submit W-9/W-8 forms without requiring a unique invite. Great for high-volume or open-access environments. Learn more

Popular Use Case:

Gig platforms can integrate this URL on their website, enabling gig workers and freelancers who work with them to submit their W-9/W-8 forms at the click of a button.

TaxBandits offers a Drop-In UI for Form W-9 that can be customized and integrated quickly into your software or portal. This provides a seamless experience while keeping the look and feel consistent with your brand. Learn more

Popular Use Case:

E-commerce businesses that work with a range of sellers or vendors can use the Drop-In UI to embed a branded W-9 form directly into their seller portals.

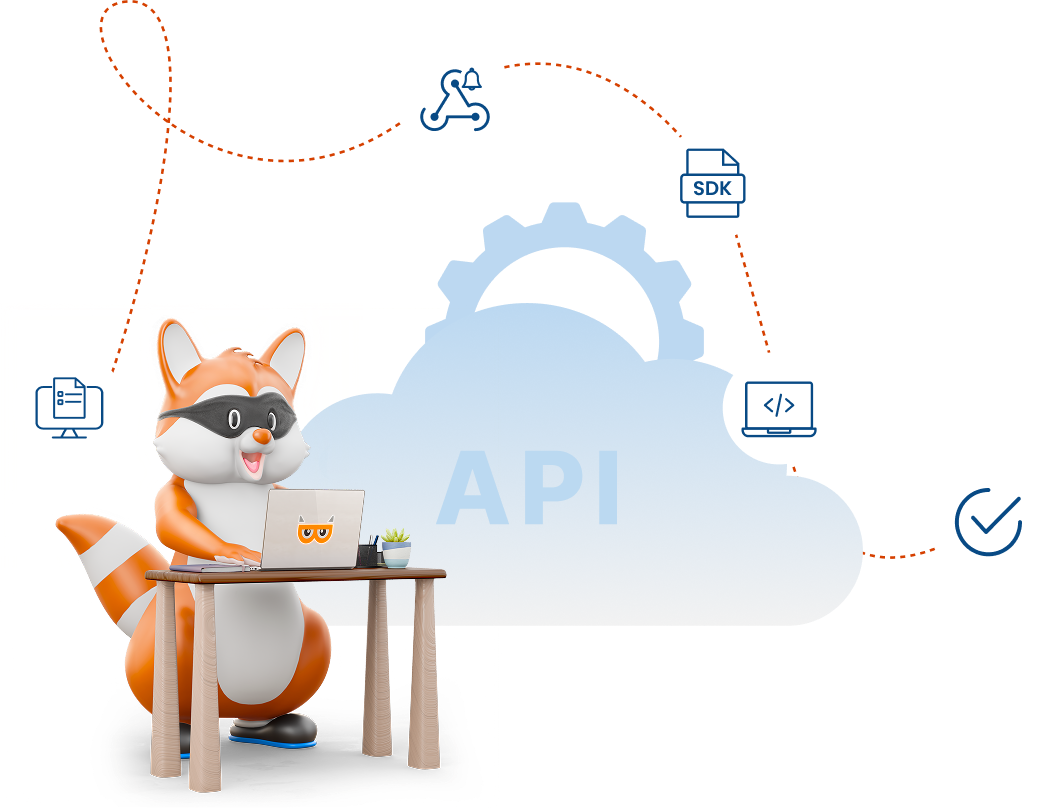

API Documentation That Makes Your Integration Easy

Get access to clear, well-structured API docs with sample requests, test workflows, and step-by-step integration guides

to build fast and file securely.

Everything Developers Need to Build with Confidence

TaxBandits provides a developer-friendly API with a range of valuable resources and tools designed specifically for developers, facilitating smooth integration.

Sandbox Environment

Simulate real-world filing scenarios in a safe test environment—perfect for validating your integration before going live.

SDKs

Jumpstart your build with SDKs available in Java, Node.js, .NET, and Python—designed to reduce dev time and speed up implementation.

Webhooks

Receive real-time updates on transmission status, rejections, and IRS acknowledgments directly in your application.

Developer Support

Get expert assistance when you need it—from onboarding guidance to technical troubleshooting, our team is here to support your build.

Everything Developers Need to Build with Confidence

TaxBandits provides a developer-friendly API with a range of valuable resources and tools designed specifically for developers, facilitating smooth integration.

Sandbox Environment

Simulate real-world filing scenarios in a safe test environment—perfect for validating your integration before going live.

SDKs

Jumpstart your build with SDKs available in Java, Node.js, .NET, and Python—designed to reduce dev time and speed up implementation.

Webhooks

Receive real-time updates on transmission status, rejections, and IRS acknowledgments directly in your application.

Developer Support

Get expert assistance when you need it—from onboarding guidance to technical troubleshooting, our team is here to support your build.

Frequently Asked Questions

Can I use the API to file extensions for my own business, or is it only for platforms?

Yes, the API can be used for both internal filings and client-facing platforms. Whether you're filing extensions for your own business or enabling users to file through your app, the integration supports both use cases.

How do I know which transmission method (e-file, fax, or paper) is required for my extension requests?

Based on IRS requirements, extension forms must be submitted using specific methods. Here’s how we handle it:

- Form 7004, 4868, 8868: Typically submitted via IRS e-file.

- Form 8809: For most information returns (e.g., 1099-MISC, 1098), filed via the paper filing of Form 8809

- Form 15397: Must be submitted by fax, as there is no e-file method available

Once you initiate the extension request via API, TaxBandits handles the transmission—whether it’s e-file, paper, or fax—according to

IRS rules.

What happens if a submission fails or is rejected by the IRS?

You’ll receive a detailed error response via the API. You can fix them and retransmit the extension request at no additional charges.

Where can I find the pricing to use the API?

Pricing depends on the form type, filing volume, and features you plan to use. To get a tailored quote, please contact our sales team for more details at sales@taxbandits.com