1099 Generations

By using the Form1099Transactions endpoint, you can record the payouts and transactions made to the vendors throughout the year. Based on these data, the applicable 1099 forms for the vendors can be generated.

There are three ways available to generate 1099 forms:

TaxBandits UI:

You can access TaxBandits UI to generate 1099 forms on your own based on the transactions recorded. Here is how:

-

Log in at (https://secure.taxbandits.com/login). You can use your Developer Console credentials to log in.

-

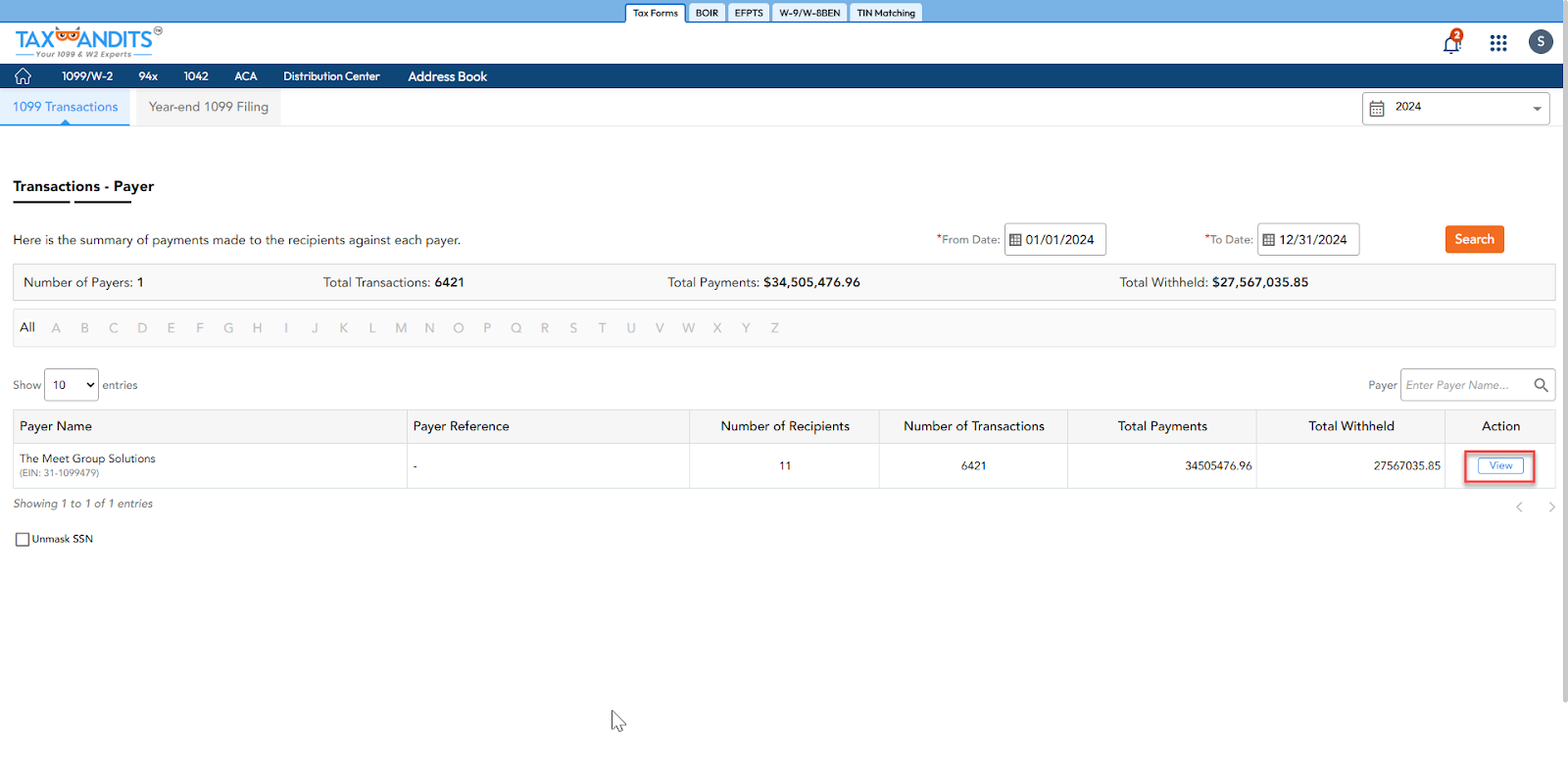

You’ll find the list of payers (businesses) added to your TaxBandits account. By clicking the ‘View’ button against a payer, you can see the payees (recipients) corresponding to each business and the total amount of payouts recorded against each of them.

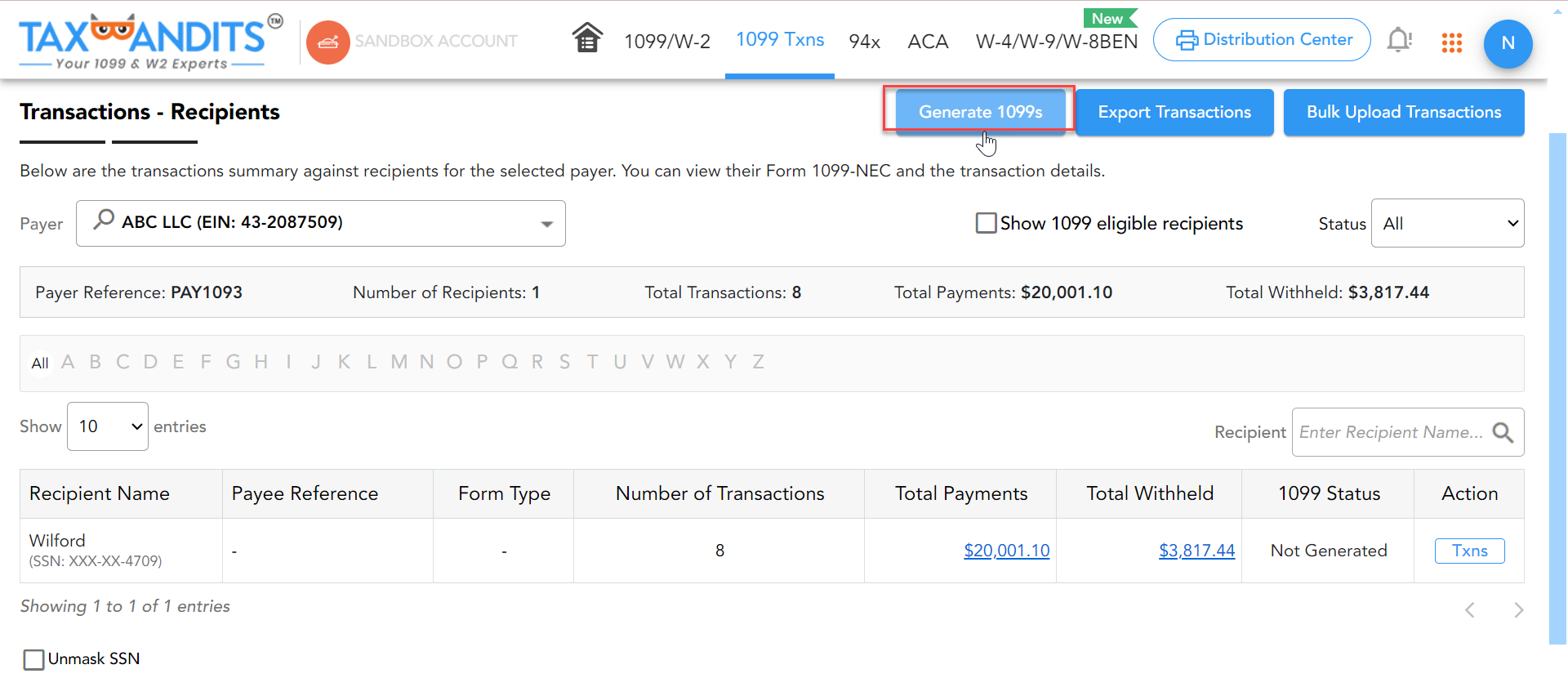

- Once reviewed, you can click ‘Generate 1099s’ to start generating the 1099 forms applicable to the payees.

- Once the forms are generated, you will have the option to review and approve the returns. After you approve, the 1099 forms will be transmitted to the IRS and State agencies (if opted). The form copies will be then distributed to the recipients.

-

Auto-generate: You can submit your request to have TaxBandits generate 1099s automatically for you based on the transactions recorded. Once generated, you can review the forms and provide your approval.

-

GenerateFromTxns: As an alternative to the above two methods, you can use this endpoint to generate the 1099 forms. Click here to see how this works