Automate Your Tax Filings Right From Your Software!

W-9 Automation

Automate the collection of W-9 forms from your vendors either via email (payer-initiated) or embedded secure URL (payee-initiated).

1099 Automation

From collecting W-9s to e-filing and distribution of 1099 forms, let our developer-friendly API automate every aspect of the 1099 process.

ACA Automation

Our API allows you to automate the ACA 1095 e-filing with the IRS and State and distribute copies via mail or online.

W-2 Automation

Enable seamless automation of W-2 e-filing with the IRS and State and distribute recipient copies via mail

or online.

94x Automation

Facilitate the automation of 940, 940 Schedule R, 941, 941 Schedule R, 943, and 944 forms right from your software.

Develop with Confidence!

- A free developer account

- A secure sandbox environment for testing

- Postman collection

- Open SDK libraries

- Comprehensive documentation with code samples

Public API

Use our API endpoints to enable the users to complete the filings within your software.

E-filing charges will be deducted from the prepaid credits in your account.

Error handling and status notifications will be handled at your end.

Partner API

Your clients' data will be transferred to TaxBandits where they can complete their filings.

It involves a negotiable revenue-sharing model based on your business requirements.

TaxBandits will take care of the error handling and status updates.

Enhance your Clients’ Filing Experience with Our Partner API

Our partner API offers a hybrid model where clients can transfer their data to TaxBandits UI from the partner’s software and complete their filings.

- Each of the partner's clients will get an individual account in TaxBandits.

- Once the data are transferred, the clients can access their TaxBandits account to e-file their returns.

TaxBandits E-filing API - A Value Addition to

Various Software Types

TaxBandits API can be integrated with different software types to automate various aspects of

tax preparation and filing. Here are some of the popular software types.

- Integrate our API and enable the automation of W-9 during the onboarding process of gig workers and freelancers.

- Record payouts and let TaxBandits automate the filing and distribution of 1099-NEC, 1099 MISC, 1099-K, and

other 1099 forms.

- Ensure tax compliance right from your Payroll / CRM software by integrating TaxBandits API.

- You can use our API to automate W-9 and e-file your W-2, 941, 940, 941 Sch R, 940 Sch R, 1095, and 1099 forms.

- Easily take care of all the tax filings for affiliate partners and merchants within your software.

- You can record transactions and automate W-9, 1099-NEC, 1099-MISC, 1099-K, and other 1099 forms efficiently.

- Enable a streamlined automation of payroll and ACA filings right from your software.

- Our API integration lets you automate W-2, 940, 941, and ACA 1095 forms with complete ease and perfection.

Services We offer through our API

Federal Filing

E-file your federal tax returns on time and comply with IRS/SSA filing requirements.

State Filing

In addition to federal tax filings, we help you meet your state filing requirements for 1099, W-2, and ACA forms.

Recipient Copy Distribution

Furnish the form copies to your recipients either via Postal Mail or Secure Online Portal.

Corrections

If any changes are needed on the 1099/W-2 forms you filed, you can file a correction.

TIN Matching

Verify that the TINs you obtained from the recipients through W-9 match the IRS database.

Form W9 Collection

Collect and manage W-9 forms from your vendors either via email or a secure URL.

Forms Supported by TaxBandits API

With TaxBandits API integration, you can simplify the preparation and e-filing of various tax returns. Our API supports

federal filing, state filing, and recipient copy distribution for major tax forms.

1099 Forms

- Form 1099-NEC

- Form 1099-MISC

- Form 1099-K

- Other 1099 Forms

Payroll Forms

- Form W-2

- Form 941

- Form 940

- Form 941 / 940 Schedule R

Others

- Form W-9

- TIN Matching

- Form 1095-C

- Form 8809

For the complete list of forms, Click here.

A Developer-Friendly API for

Automating W9, 1099 W-2, 94x, &

1095 Filings

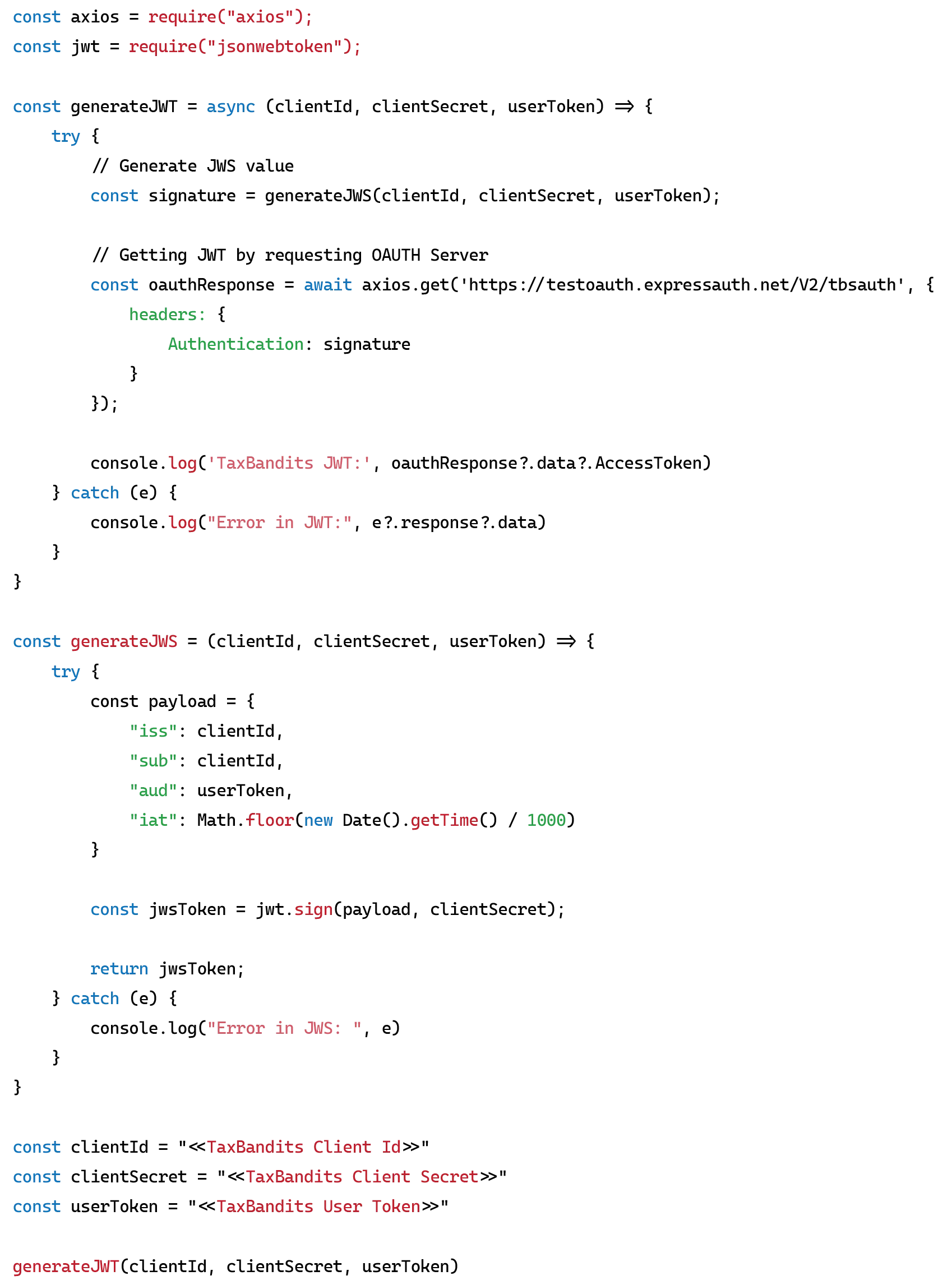

Sandbox Environment

The Sandbox environment allows the simulation of end-to-end e-filing procedures and TIN validation for testing purposes.

SDK

TaxBandits offers SDK libraries in various programming languages, such as Java, Node JS, .Net, and Python, that help you use our API.

Clear Documentation

Our API comes with comprehensive documentation with clear instructions that illustrate how endpoints are used to create, update, validate, and e-file tax forms.

Advanced Security

TaxBandits is a SOC-2 Certified company that utilizes a number of security protocols to safeguard sensitive information throughout the process.